The question on every investor’s mind right now is simple: if BTC USD keeps dropping, does Strategy get kicked out of major stock indices? With Bitcoin sliding from six-figure euphoria to the high-$80Ks, and Michael Saylor’s Bitcoin-heavy corporate strategy under pressure, the debate has exploded across financial media.

And it’s a fair concern – MSTR has become a leveraged proxy for BTC price action, rising faster than Bitcoin on the way up and bleeding harder on the way down. However, despite market fears, a Bitcoin move to $75K wouldn’t automatically trigger index removal.

The reality is more nuanced, tied to market-cap rankings, premium collapse, and looming index-provider reviews rather than a single Bitcoin price threshold.

Could Strategy Be Removed from Major Indices if BTC USD Falls?

Right now, there’s no rule saying Strategy gets removed from the Nasdaq 100 just because BTC USD hits $75K. Nasdaq’s criteria focus on market cap rankings, liquidity, and periodic reviews, not Bitcoin’s price levels.

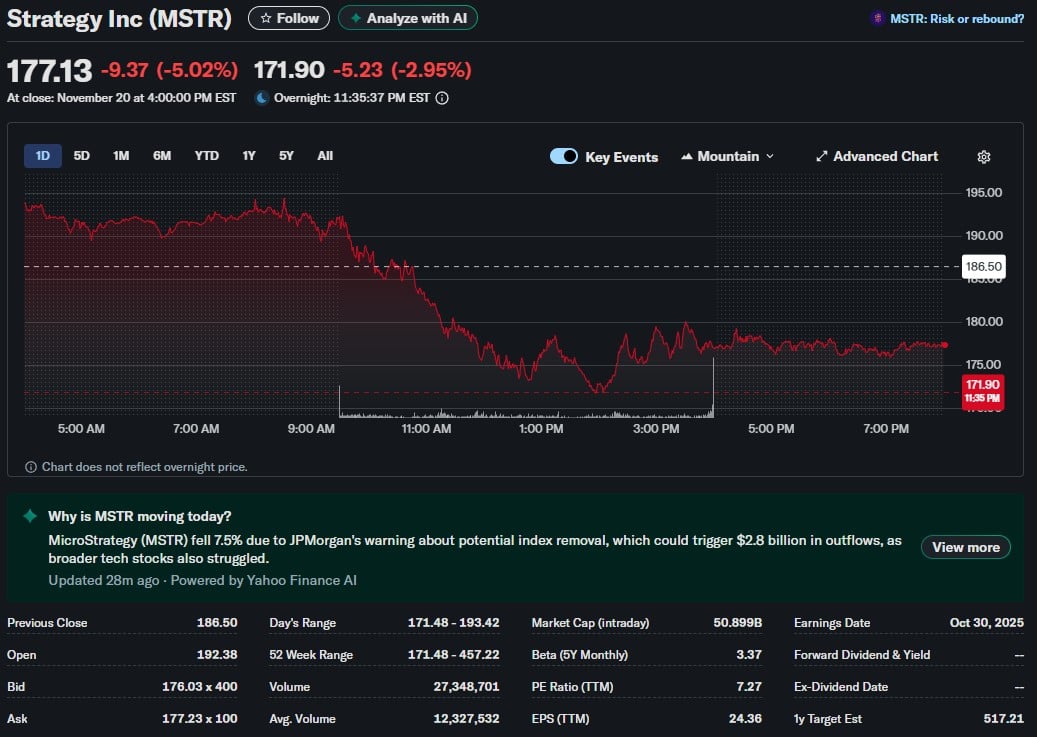

Strategy (ticker MSTR) still holds a market cap of around $51Bn. After JPMorgan warned of potential index removal, MSTR fell by over 5%.

(Source – Yahoo Finance)

That keeps it safely above the usual lower cutoff range of $20-40Bn for Nasdaq 100 removals.

Even if Bitcoin dropped to $75K, Strategy’s massive 650,000+ BTC trove would still be worth nearly $49Bn. Yes, the stock would likely fall harder than Bitcoin, because it trades like a leveraged BTC ETF, but it would remain sizable enough to stay inside the index.

🚨 BREAKING:

Michael Saylor’s Strategy ($MSTR) will be removed from both the Nasdaq-100 and the MSCI USA IndexThe stock has fallen 60% from its peak and no longer meets the size & performance thresholds required for inclusion

A brutal hit for a major moment for one of… pic.twitter.com/fxoMVaHvs5

— RozeFi (@DeFiRoze) November 21, 2025

There is real risk, however, just not the kind social media sensationalizes.

The real danger is the MSCI review scheduled for January 15, 2026, where MSCI is considering removing companies whose primary business is simply holding Bitcoin. JPMorgan analysts warn such a move could trigger $2,8Bn in forced selling, and if other index families follow suit, total outflows could reach $11Bn.

This risk stems from Strategy’s business model classification, not any single BTC/USD price level. If MSTR is deemed a “Bitcoin holding vehicle” rather than a software or cloud company, index providers may decide it doesn’t belong in the index.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Is a BTC USD Drop to $75K the Trigger Point? Or Just Another Stress Test?

Many traders cite the $75K level because ot roughly aligns with the Strategy’s average Bitcoin acquisition price. Falling below this would push the company into unrealized losses on its balance sheet. But index providers don’t care about Saylor’s break-even – they care about size, liquidity, and sector classification.

Strategy has acquired 8,178 BTC for ~$835.6 million at ~$102,171 per bitcoin and has achieved BTC Yield of 27.8% YTD 2025. As of 11/16/2025, we hodl 649,870 $BTC acquired for ~$48.37 billion at ~$74,433 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STREhttps://t.co/72HMHUH2fa

— Strategy (@Strategy) November 17, 2025

Still, a BTC move to $75K wouldn’t be painless.

MSTR has already fallen 40% in the past month as BTC dropped into the high $80Ks. Its premium to net BTC holdings (once above 2.7X) has collapsed to almost zero. Trading volume is falling, and passive ETF exposure is under scrutiny.

If Bitcoin keeps weakening, Strategy could enter a psychological death zone where active managers rotate out due to volatility. Passive funds trim exposure if MSCI delists it, and the company struggles to raise debt against its BTC holdings.

So while $75K is not a removal trigger, it is absolutely a sentiment trigger, and one that could amplify selling pressure ahead of the January index decision.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

What Happens to Strategy if MSCI Pulls the Plug?

If MSCI excludes MSTR (a real possibility), it becomes harder for the company to attract institutional support. Index-focused funds hold a massive chunk of their float. Removal would mean immediate mechanical selling, lower liquidity, higher volatility, and increased financing difficulty for Saylor’s future Bitcoin purchases.

It wouldn’t kill the company, but it would hit the stock harder than a simple BTC USD move. And that’s why analysts view MSCI’s upcoming call as the true catalyst, not a Bitcoin dip to $75K.

DISCOVER: 10+ Next Crypto to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

JPMorgan hints at the possible removal of Strategy from the Nasdaq 100.

Is MSCI going to pull the plug on Strategy?

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content