Those were only practice rate cuts, unironically, and we’re starting off Uptober with a solid pump. Sui Crypto has joined the upward move, with traders eyeing $5 by 2026 as a plausible milestone should the broader rally continue.

If this is a fake pump, then I’m looking forward to the soup line.

Happy Uptober 🚀

— Michael Saylor (@saylor) October 1, 2025

Meanwhile, BlackRock, the SUI Group, the Sui Foundation, and Ethena just announced plans to launch suiUSDe (a native synthetic dollar) and USDi (backed by BlackRock’s tokenized money market fund BUIDL).

Unlike typical stablecoins, these will embed revenue flows back into the protocol, letting

5.07%

reinvest in its own ecosystem. Here’s what you need to know, and if SUI can hit $5 before 2026:

Why BlackRock Chose Sui Crypto: How Does suiUSDe & USDi Work?

The dual-token strategy is about to send SUI to $5. suiUSDe will be backed by a basket of digital assets, plus short futures positions, allowing the stablecoin to operate over-collateralized and generate yield. USDi, on the other hand, will link to BlackRock’s BUIDL fund offering exposure to institutional-grade money-market liquidity.

All the net income, after costs, will be reinvested to purchase SUI tokens through both Sui’s foundation and SUIG, thereby boosting tokenomics and native token demand.

“SUIG launching suiUSDe represents our first step to building infrastructure as a treasury vehicle … focused on delivering scalable value for our shareholders,” said Marius Barnett, SUIG Chairman.

Sui devs expect both USDi and suiUSDe to go live before the end of 2025.

DISCOVER: Next 1000x Crypto – 13 Coins That Could 1000x in 2025

What Is “The Make It” SUI Stack?

What is the “make it” SUI stack? About ten fiddy.

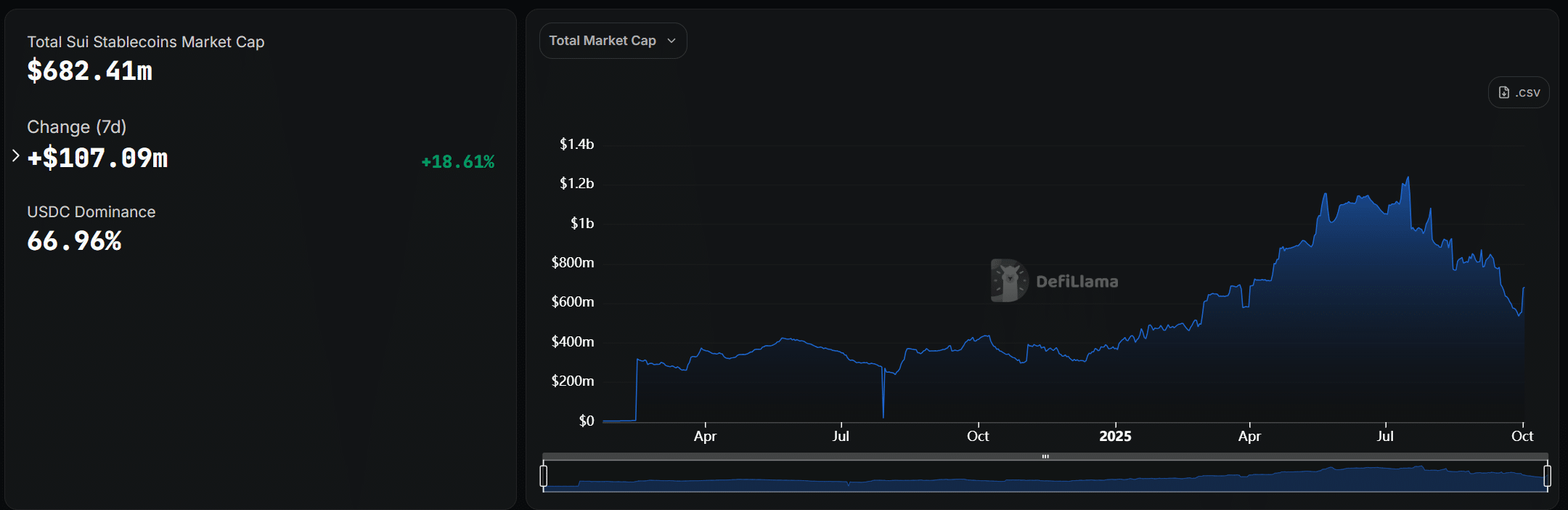

All jokes aside, in August, Sui recorded a record $229 Bn in stablecoin transfer volume, outpacing past records. That kind of velocity infrastructure is rare outside top-tier chains.

This native stablecoin push also gives Sui a competitive edge in the Cosmos / interchain narrative. Cosmos’ IBC model encourages cross-chain flows, and Sui’s ability to host its own stable assets may attract liquidity that otherwise might flow into ATOM, OSMO, or other IBC ports.

At $3.56, a realistic “make it” stack is 1,500–3,000 SUI in the $3.25–$3.75 range, with 30–50% staked. Some of 99Bitcoins’ analyst team will hold through the USDi/suiUSDe launch and near-term futures listings, then begin scaling out between $5 and $6 by 2026.

DISCOVER: 20+ Next Crypto to Explode in 2025

Macro & Market Risks: Can SUI Crypto Hit $5 Before 2026?

As the GENIUS Act introduces tighter stablecoin regulation, stablecoins need visible, verifiable incentive layers. Sui could offer that clarity without stripping DeFi of its appeal.

The formula is the following: BlackRock supplies the trust, Ethena the scale, and Sui the raw speed. Don’t fade Sui. It could be on the road to $5 in Uptober.

EXPLORE: XRP Price Jumps 11% After SEC Crypto Unit Tease XRP ETF Progress

Key Takeaways

-

Those were only practice rate cuts, unironically, and we’re starting off Uptober with a solid pump. Sui Crypto has joined the upward move. -

This native stablecoin push also gives Sui a competitive edge in the Cosmos / interchain narrative.

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content