Solana is back in focus as large traders build fresh futures positions while Bitcoin holds near recent highs. SOL trades around $142 on December 10, up about +6% in the past day.

According to CoinGecko, spot activity is strong too, with roughly $6.3Bn in volume.

Traders are rotating into high-beta majors again, and Solana often becomes the go-to choice when sentiment improves. Bitcoin’s steady position near the top range gives the market a stable backdrop, and Solana is reacting quickly to that tone.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

What Do On-Chain Metrics Reveal About Solana’s Recent Move?

Derivatives data shows why this bounce stands out. CoinGlass reports SOL futures open interest near $7.5Bn, with about $17Bn in 24-hour futures turnover.

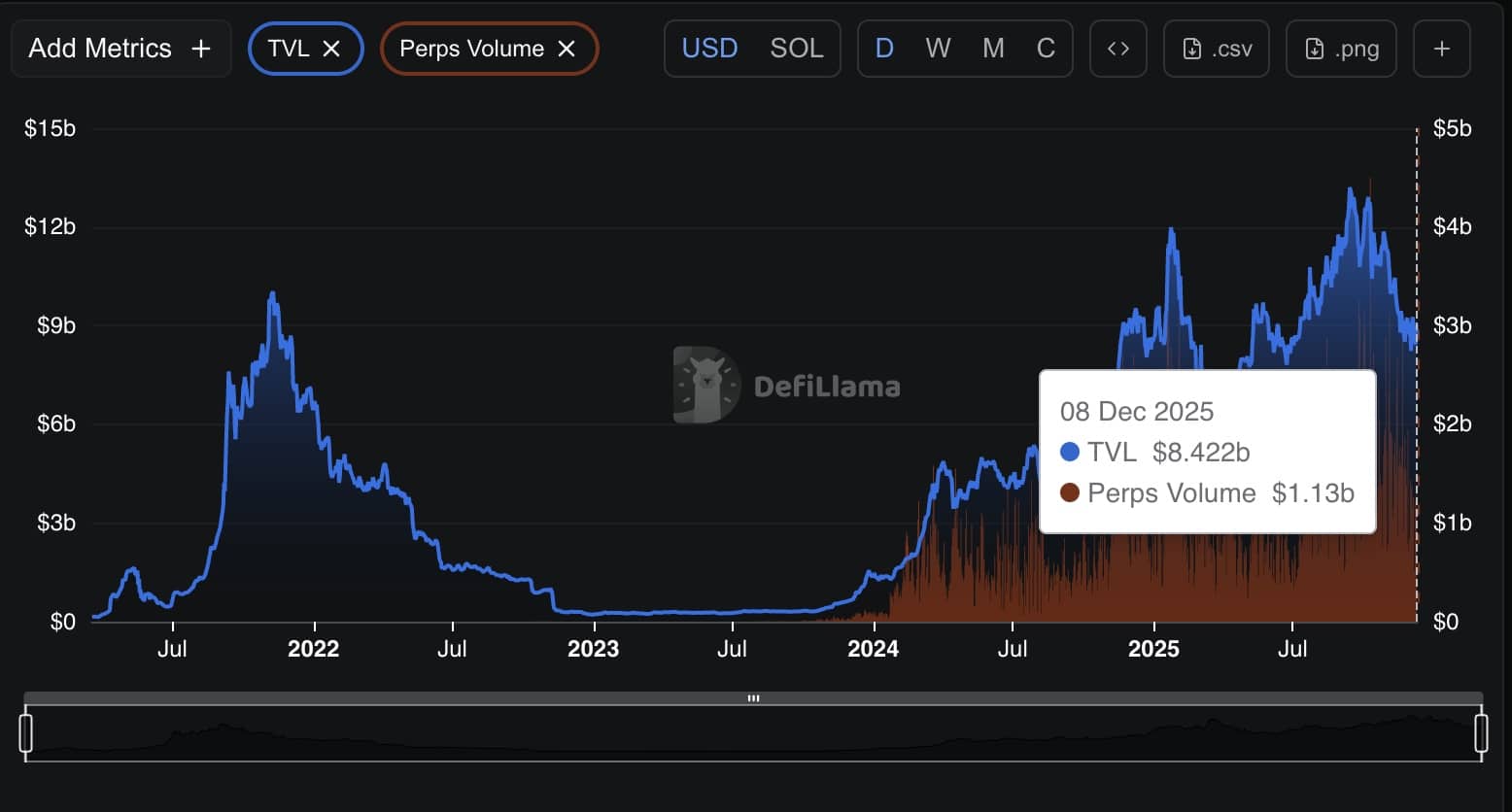

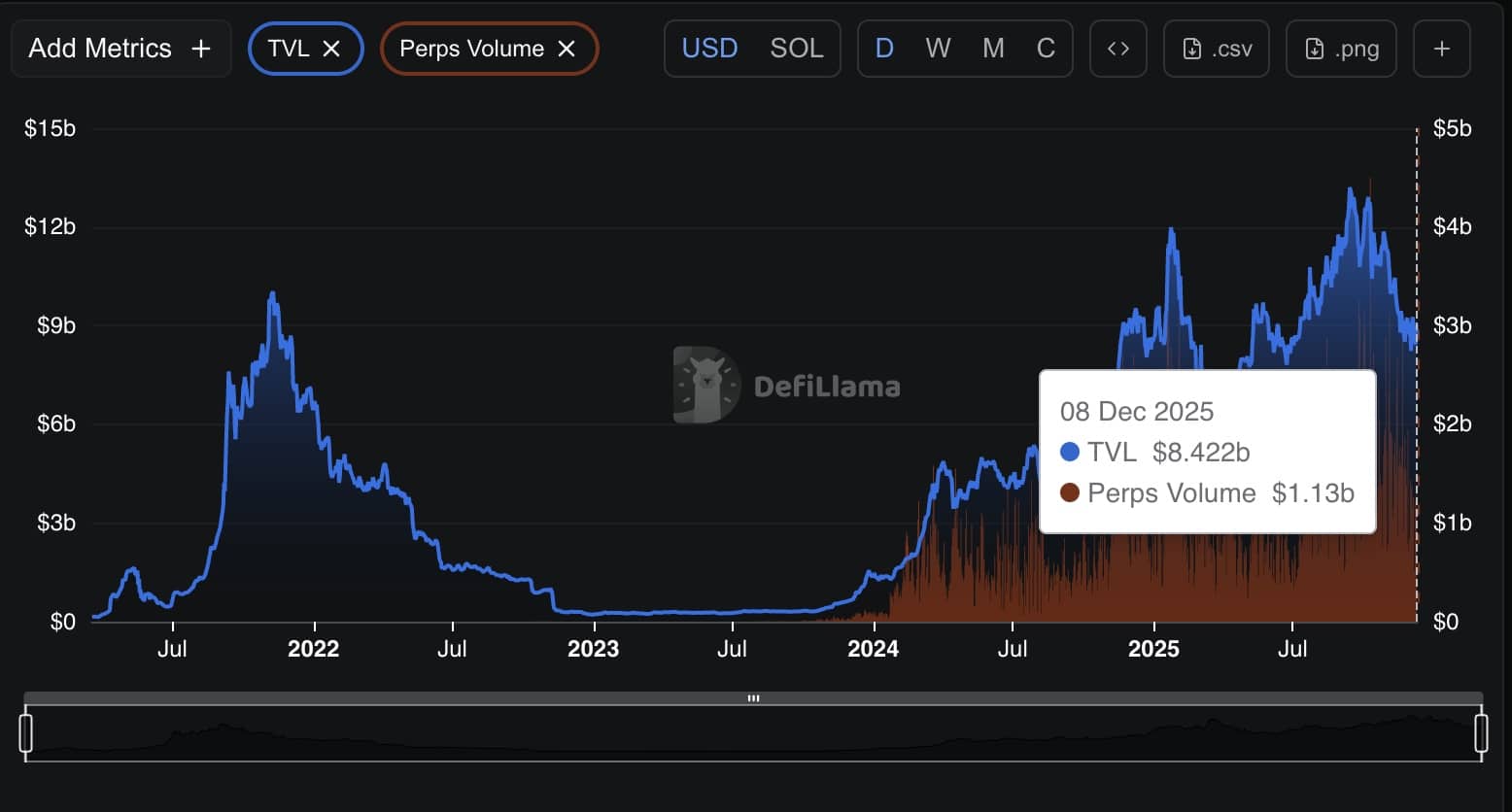

Centralized exchanges saw another $1.6 billion in spot trading. This mix suggests an active market, but not one running too hot, which leaves room for more positions if the trend continues. DeFiLlama shows Solana perp DEXs handling about $1.13 billion in volume over the past day.

DISCOVER: Top Solana Meme Coins to Buy in 2025

Roughly $463M remains locked in on-chain open interest tied to Solana perpetuals.

It’s a sign that both centralized and on-chain traders are leaning into the move, but doing so with measured positioning rather than excess.

Across the Solana ecosystem, daily spot volume on DEXs sits near $3.5 billion.

The network also logged more than 2.3M active addresses and close to 65M transactions in the past 24 hours.

DISCOVER: 20+ Next Crypto to Explode in 2025

Solana Price Prediction: Will SOL Break the Range After Holding the $145–$150 Zone?

Solana is finally showing a bit of strength after weeks of slow trading. The price is now pushing against a key downtrend line that has blocked every rally since early October.

The analyst’s chart shows SOL holding just above the mid-range near $145–$150 after several attempts to form a base around $135. Recent candles tell the story. They show higher lows pressing into a flattening trendline, which suggests the selling pressure is losing steam.

If buyers keep this pace, SOL may soon test a full breakout above the range that has held it back for months. Multiple horizontal levels on the chart show how SOL has stayed locked inside a broad range. The first barrier sits near $165.

The next zone, between $185 and $190, marks an area where sellers pushed back in earlier moves. SOL is now pressing against the descending trendline, hinting at a possible breakout attempt. A close above the trendline would signal the first clear shift in market structure since the November pullback.

The analyst summed up the setup in simple terms, saying: “Eyes on $SOL, breaching up the main downtrend resistance and the horizontal range. Looking absolutely primed for the full bullish breakout.”

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content