Bitcoin price tumbled on Monday as weak ETF inflows and quiet trading in derivatives took the edge off any rally attempt, even while US stocks and gold pushed higher on rising bets that interest rates could soon fall.

The world’s largest cryptocurrency again failed to reclaim $93,000, despite a supportive tone across traditional markets and fresh strength in precious metals.

With the S&P 500 sitting less than 1% below its all-time high, traders kept asking the same question: what would it take to lift Bitcoin into a sustained rally instead of another brief pop that fades just as quickly.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

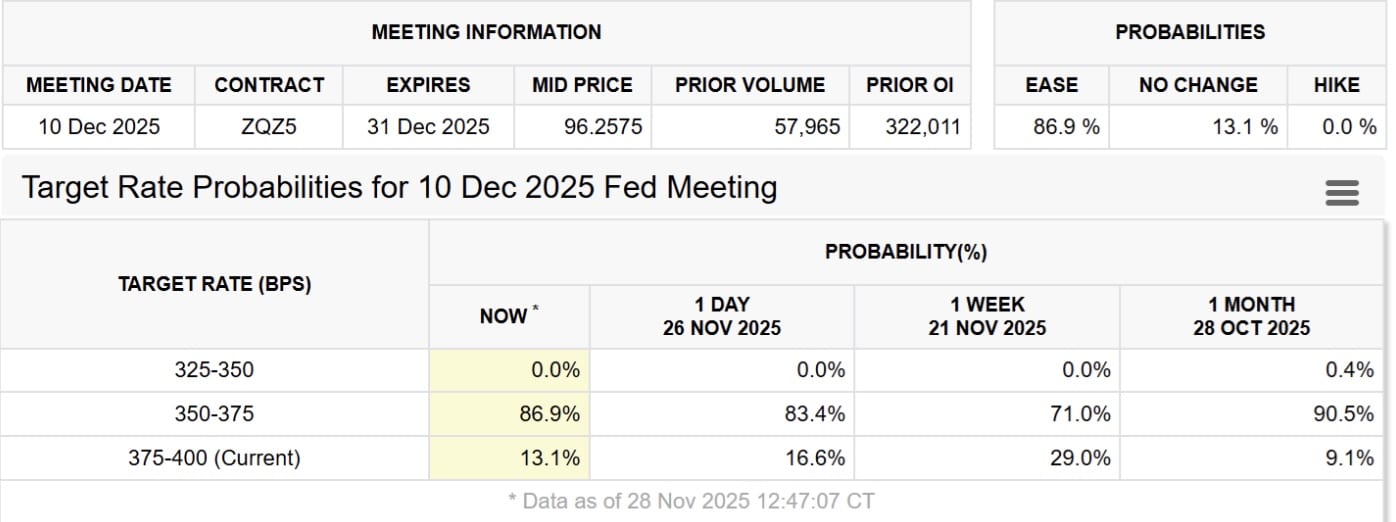

What Do CME’s December Rate-Cut Odds Say About Market Expectations?

Futures markets point to growing confidence that policymakers may act soon.

Data from CME Group showed traders now see an 87% chance of a rate cut on December 10. A week earlier, those odds stood at 71%.

For now, Bitcoin is tracking sideways. And until money flows improve, many traders remain cautious about chasing prices higher.

Fresh signs of strain in the US job market are shaping how investors see the path ahead for interest rates.

The Labor Department said continuing jobless claims rose to 1.96M in the week ending November 15.

That jump has made traders more confident that the Federal Reserve may soon lean toward easier policy.

But in crypto markets, the mood is still cautious, not confident. Bitcoin’s recent drop has not sparked forced sell-offs in derivatives. At the same time, traders are not rushing to take large bullish bets either.

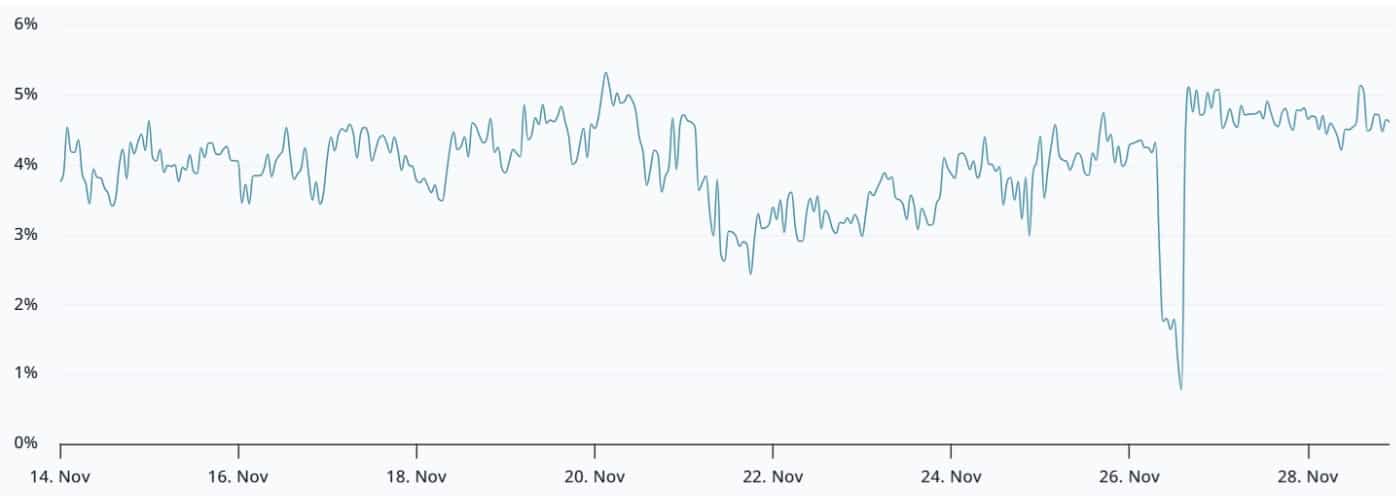

Bitcoin’s monthly futures were trading at a 4% premium to spot prices on Saturday, about the same as a week earlier.

In stronger markets, this gap typically ranges between 5% and 10%, reflecting funding costs and risk. The smaller spread suggests traders are staying cautious rather than betting aggressively on a rebound.

That restraint likely reflects Bitcoin’s roughly -18% decline over the past month. So far, the pullback has not been followed by clear signs that buyers are stepping back in with conviction.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Are Bitcoin Options Traders Hedging for More Downside?

Options markets tell a similar story. When hedge funds and major trading desks anticipate further losses, activity in put options tends to increase as investors seek protection against potential further declines.

By the end of the week, traders were leaning defensive. Trading in put options outpaced calls on both Thursday and Friday, a sign of lingering nerves.

In a calm market, put-to-call premiums usually stay near 1.3x or lower. This time, the gap was smaller than the brief spike on November 21, when downside bets surged close to 5x. Still, derivatives sentiment has not settled.

One reason is that weak money is coming into Bitcoin exchange-traded funds. Net inflows for the week ending November 28 reached just $70M. That points to limited interest from big institutions.

CoinGlass data shows that none of the public companies known to hold Bitcoin as a core asset added to their stacks over the past two weeks. That took away another possible push higher.

Outside crypto, the mood turned more risk-friendly. During the US holiday season, President Donald Trump reiterated plans to cut income taxes, stating that tariff revenue would cover the resulting gap.

As investors grew comfortable with higher government borrowing, demand rose for assets with limited supply. Gold climbed 3.8% for the week. Silver hit a fresh record. Bitcoin, by contrast, stayed stuck in a narrow range.

DISCOVER: 10+ Next Crypto to 100X In 2025

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content