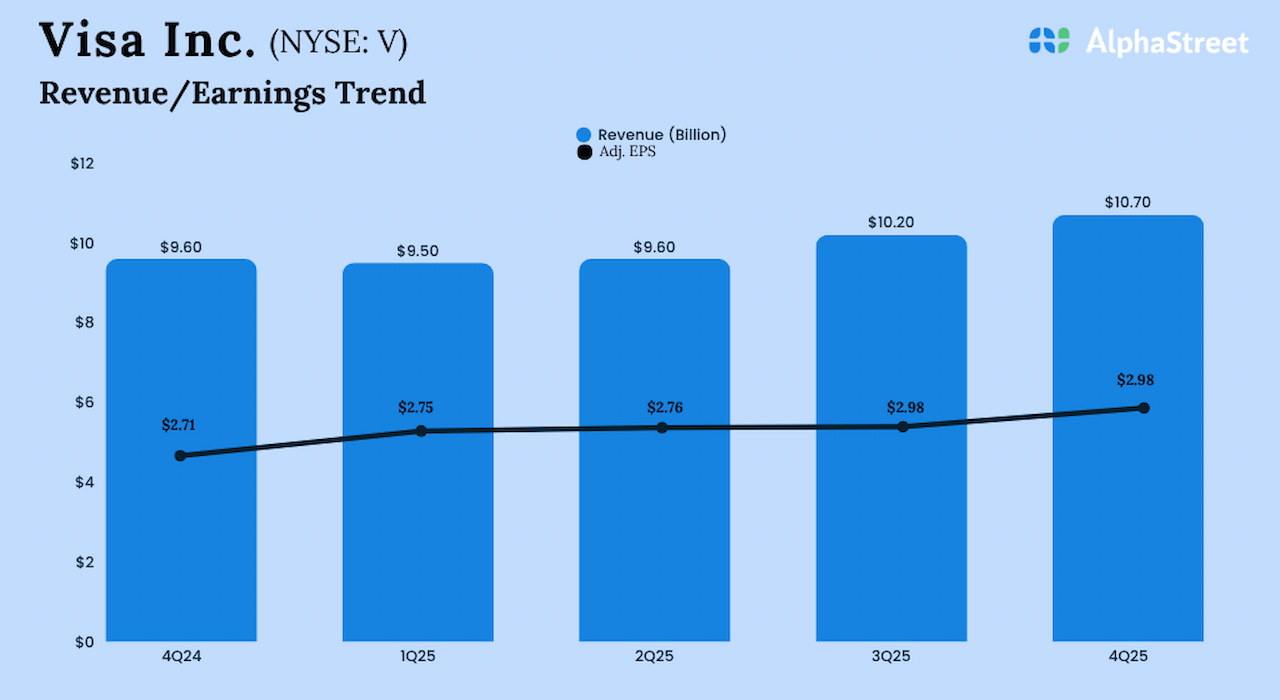

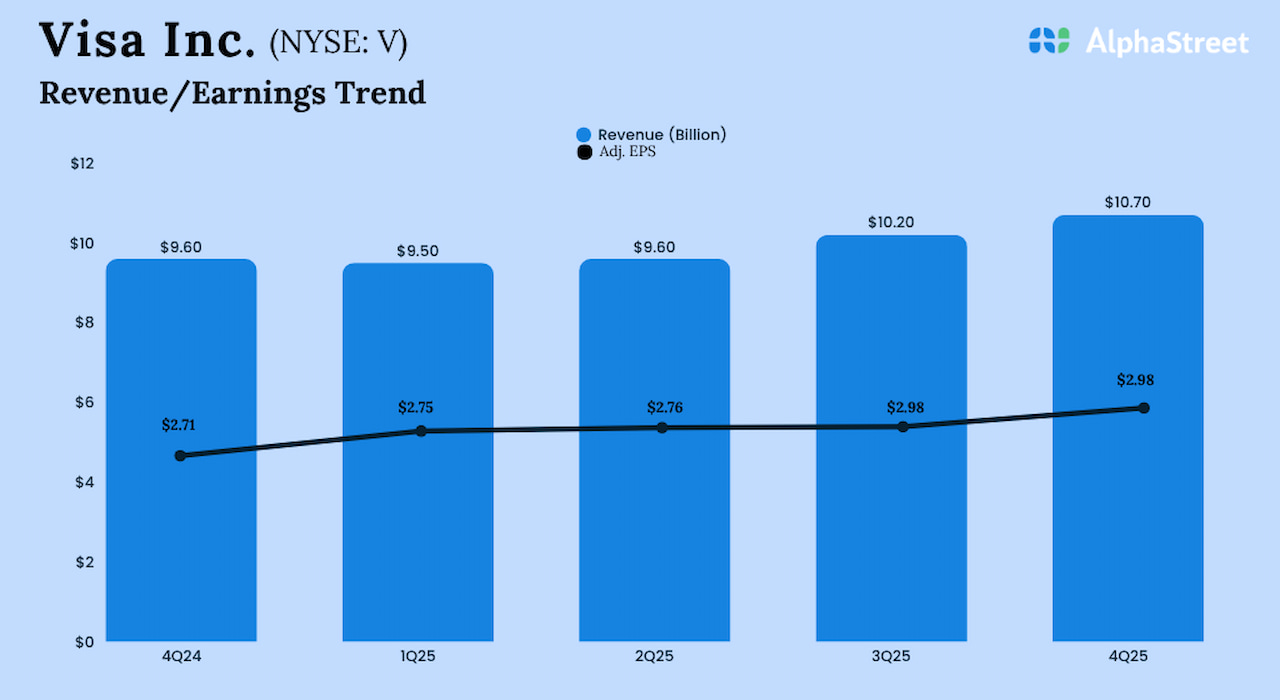

Visa, Inc. (NYSE: V) on Tuesday reported an increase in revenues for the fourth quarter of fiscal 2025, which translated into a 10% growth in adjusted earnings.

Fourth-quarter revenue grew 12% annually to $10.7 billion, aided by an increase in payment volume amid continued healthy consumer spending. The top-line beat analysts’ estimates.

As a result, adjusted earnings rose to $2.98 per share in Q4 from $2.71 per share last year, exceeding expectations. On a reported basis, net income was $5.1 billion or $2.62 per share, vs. $5.3 billion or $2.65 per share reported in Q4 2024.

“We continued to invest in our Visa as a Service stack to serve as a hyperscaler across the payments ecosystem. As technologies like AI-driven commerce, real-time money movement, tokenization, and stablecoins converge to reshape commerce, our focus on innovation and product development positions Visa to lead this transformation,” said Ryan McInerney, Chief Executive Officer, Visa.

During the quarter, the company repurchased around 14 million shares of its common stock at an average cost of $349.77 per share for $4.9 billion.

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content