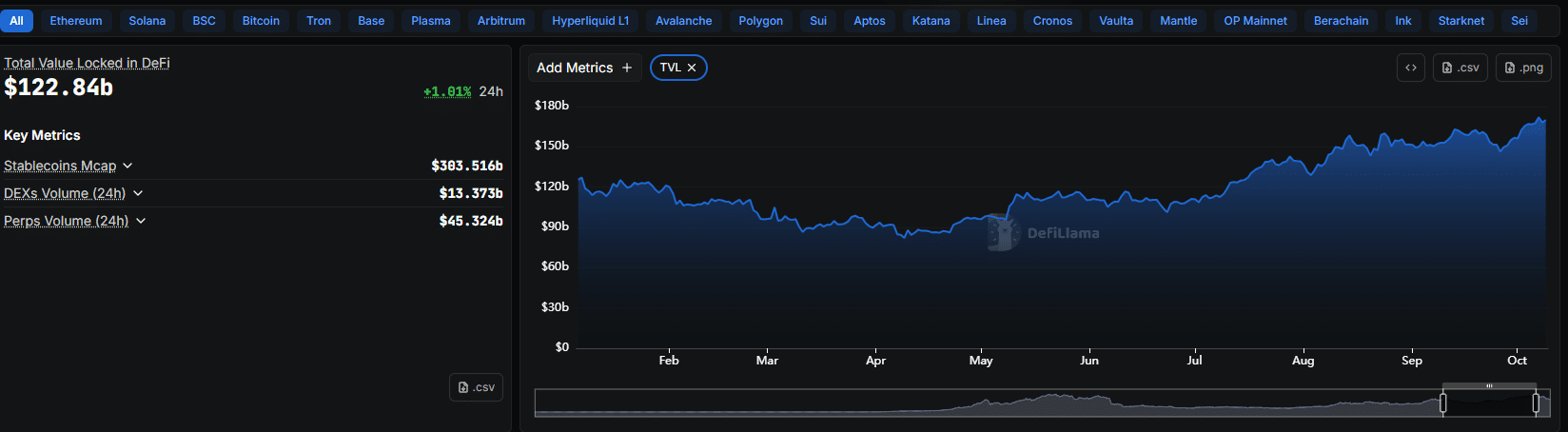

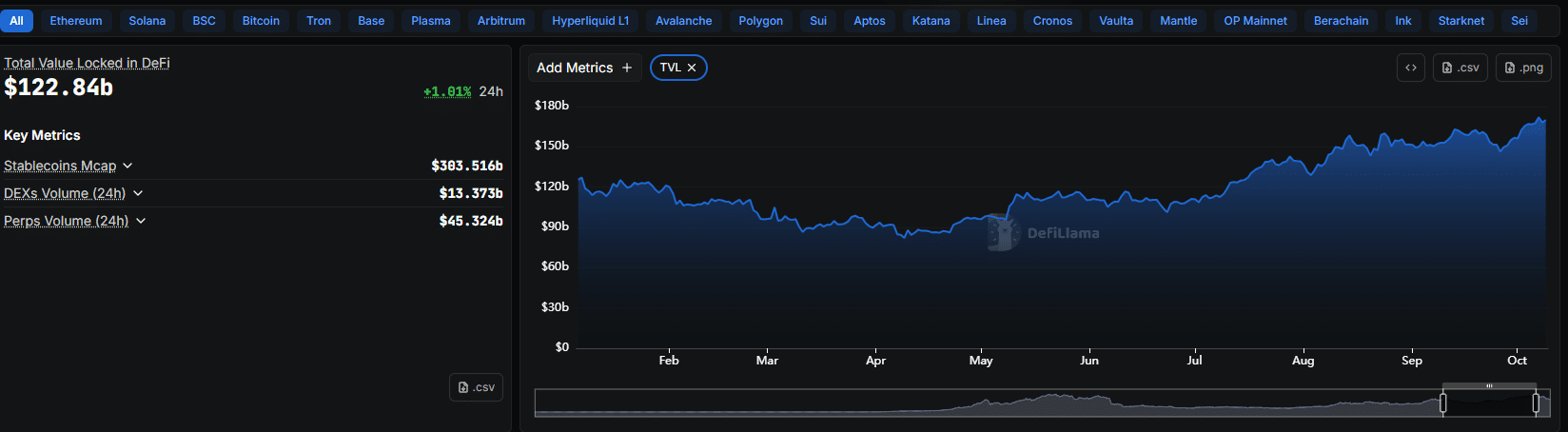

It has been a mixed year for DeFi, if total value locked (TVL) is the only metric to watch. DeFi protocols, including Uniswap, cumulatively manage over $122 billion at press time, roughly the same amount printed in January.

Aave is still the king, with nearly $32 billion under management, while Lido and other liquid staking platforms dominate the top 10. Uniswap is the undisputed leader of DEX. With a presence in 39 chains, the swapping platform is the most adopted in the top 20.

(Source: DefiLlama)

Despite this otherwise superb growth, UNI crypto, the native governance token behind the mega DEX, is yet to reclaim 2021 highs. UNI crypto is perched in the top 50, flipping Toncoin and Polkadot, but holders desire even more given its lead.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

UNI Crypto Spiked Before Falling: Will UNI USDT Reclaim $10?

There were hints earlier this month that UNI USDT was ready to take off. On November 10, UNI crypto surged by over 50%, reversing sharp losses of October 10.

Although traders piled in, buying on every dip and expecting the token to extend gains throughout November, it didn’t come to pass. On November 11, prices stalled before falling. UNI USDT has since been printing lower lows, stabilizing above $7.

The good news for UNI bulls is that the uptrend is intact. Notably, the gains of November 10 have not been reversed.

What’s clear on the UNI USDT daily chart is a bull flag. If buyers break above the current consolidation, surging above $8.5, there could be more room for more expansion towards November highs.

DISCOVER: 10+ Next Crypto to 100X In 2025

Uniswap Prepares For UNIfication But There is a Problem

The reason why UNI USDT erupted to as high as $10 on November 10 follows the welcomed “UNIfication” proposal by the team.

To UNIfy Uniswap, the team proposed a sweeping overhaul to its tokenomics. After implementation, Uniswap will redirect a portion of fees from pools, burn 100 million UNI from the treasury, and merging teams under Uniswap Labs to streamline growth.

As of November 18, the proposal received overwhelming support during the “temperature check” and is ready for onchain voting. Nearly all those who voted at this stage agreed that the proposal would benefit token holders.

(Source: Snapshot)

However, there is a problem.

With UNIfication, Uniswap will establish a permanent growth budget of 20M UNI per year. These tokens will be vested quarterly starting from January 2026.

There are no further details on how this “slush fund” will be used, but the team says it will be allocated towards funding ecosystem initiatives, such as issuing grants and sponsoring builder programs.

While funding ecosystem initiatives is beneficial, some argue that the 20 million UNI budget is not only excessive but can also create structural economic misalignment, effectively taxing the success of Uniswap.

When a Fixed Token Budget Becomes a Tax on Success

The UNIfication proposal introduces a growth budget of 20 million UNI per year to fund protocol development alongside activating the fee switch. While the fee switch itself is a positive step toward value capture, the growth…

— G3ronimo (@RyskyGeronimo) November 18, 2025

Since the fund is fixed at 20 million UNI per year, there is a risk that this design will eventually water down UNI’s valuation and supply dynamics, diverting value from UNI holders to unchecked spending.

For transparency, the feel among critics is that the proposal should specify precisely how the 20M UNI will be allocated and how grants will be distributed to teams based on which performance metrics.

DISCOVER: 20+ Next Crypto to Explode in 2025

Uniswap UNIfication Passed, 20M UNI Per Year A Tax?

-

UNI USDT is bullish but stagnant -

Will UNI crypto break above $10? -

UNIfication passed to the next stage -

Concern over 20M UNI per year allocation to the team

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content