TON price is gaining renewed attention as Telegram crypto ecosystem developments converge with growing institutional cash flows, prompting the question: could Toncoin (TON) stage a comeback driven by major treasury plays and overall altcoin season momentum?

With public companies such as TON Strategy Co. and AlphaTON Capital Corp. accumulating TON in their corporate treasuries, and Telegram’s 900 million-plus user base primed for crypto adoption, some analysts believe a move toward $3.50 in November is feasible if execution pans out.

What Makes Telegram Crypto’s Toncoin Ecosystem Worth Watching?

Toncoin is the native token of The Open Network (TON), developed initially as the blockchain for the messaging giant Telegram. While Gram itself was halted by the SEC in 2020, TON survived as a decentralised protocol and today integrates directly with Telegram’s wallet and mini-app ecosystem.

BREAKING: Pavel Durov – We agreed with the TON Foundation to make TON the exclusive blockchain partner of Telegram.

TON will be our blockchain infrastructure for tokenization, payouts, mini app integrations, and more 🏆

This standardization will be great for Telegram users —… pic.twitter.com/Z9yXwjEAXR

— Viktor 🧡 (@s0meone_u_know) January 22, 2025

Toncoin supports native chat-payments and Telegram Mini Apps, and it has a user interface through Telegram’s wallet. The network’s link to Telegram provides a unique “on-ramp” for mainstream users into crypto, a rare asset compared to many altcoins. That integration alone has led to renewed interest, but the next layer is now under focus.

DISCOVER: 10+ Next Crypto to 100X In 2025

How Are Corporate Treasury Plans Shaping Toncoin’s Outlook and Could TON Price Climb?

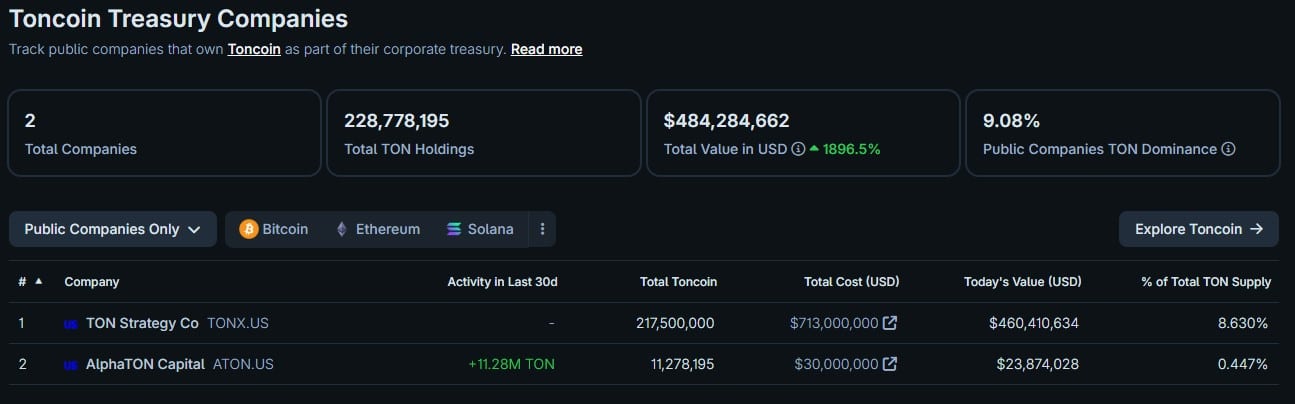

In recent months, public companies have begun accumulating TON as a core treasury asset, signalling deeper structural demand. For example, TON Strategy Co (Nasdaq: TONX) announced $558 million treasury asset plan. Meanwhile, AlphaTON Capital Corp launched its TON-centric treasury strategy, securing initial TON purchases.

ICYMI: Exploring TON Strategy’s $558 million treasury company with Exec. Chairman Manuel Stotz@Timccopeland and @imyoungsparks were joined by @ManuelStotz to hear how @ton_blockchain‘s integration with Telegram could drive crypto’s next billion users, and @tonstrat‘s plans for… pic.twitter.com/KMdRGXdqyh

— The Block Podcasts (@TheBlockPods) October 22, 2025

These moves serve multiple functions: locking up supply, aligning corporate value with the token, and providing staking yield. Analysts view this as a potential catalyst for TON price improvement because when public firms hold large stakes and reduce circulating supply, it can tighten market dynamics in favour of upward moves.

Suppose demand ramps up and overall crypto sentiment enters a bullish phase. In that case, some models see a target near $3.50 in November as plausible, especially given historical rallies tied to Telegram-based adoption narratives.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Can TON Price Regain $3.50?

From a technical view, Toncoin is under accumulation pressure but still faces supply-overhang risks. Technical data highlight that corporate treasuries hold roughly 9% of TON’s total supply based on public data.

(Source – Coingecko)

Chart-wise

0.67%

is currently consolidating after the October 10, 2025, crash, recovering from $0.54 level. TON price is currently at $2.12, consolidating under the resistance of the 200 EMA and the SMA band. With the good news that we got and the possible volume we can send, we can once again test the $3.5 level.

(Source – TradingView)

On a higher time frame, if the TON price can’t hold the support, it will test the $1.8 diagonal support formed back in 2023. Weekly, we can see that there is hidden bullish divergence on the RSI indicator, suggesting that the bottom could be near. MACD is also slightly negative but circling the baseline.

(Source – TradingView)

With corporate treasuries backing the narrative and Telegram’s ecosystem providing the real-world bridge, the technical setup appears ripe, but investors should monitor market conditions and altcoin season strength.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

TON Strategy Co announced $558M treasury asset plan.

Is TON price going to test once again the $3.5 level?

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content