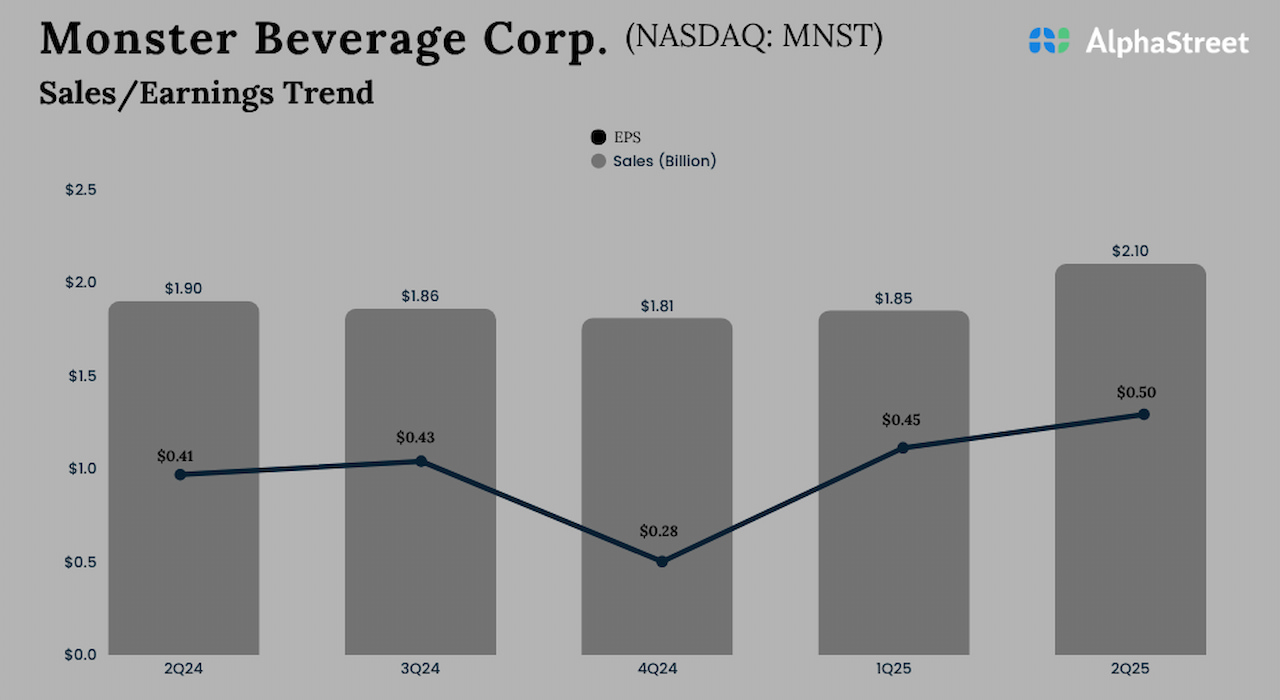

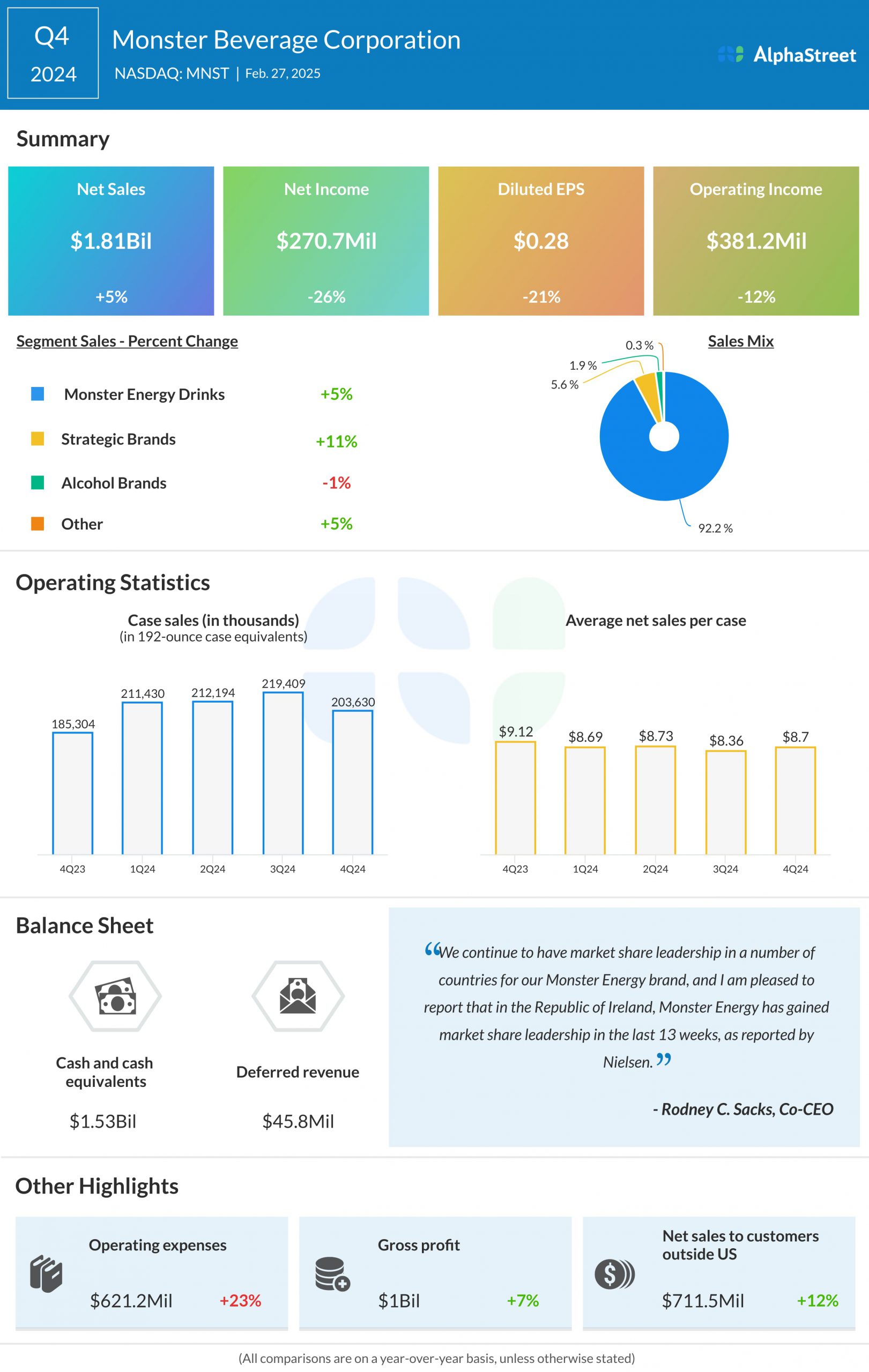

MNST Earnings: A snapshot of Monster Beverage’s Q2 2025 report

Monster Beverage Corporation (NASDAQ: MNST) on Friday announced earnings for the second quarter of fiscal 2025, reporting an increase in sales and adjusted profit. Second-quarter net sales increased 11% percent to $2.11 billion from $1.90 billion in the same period last year. On a currency-adjusted basis, sales were up 11.4%. Adjusted earnings, exclusive of litigation … Read more

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content