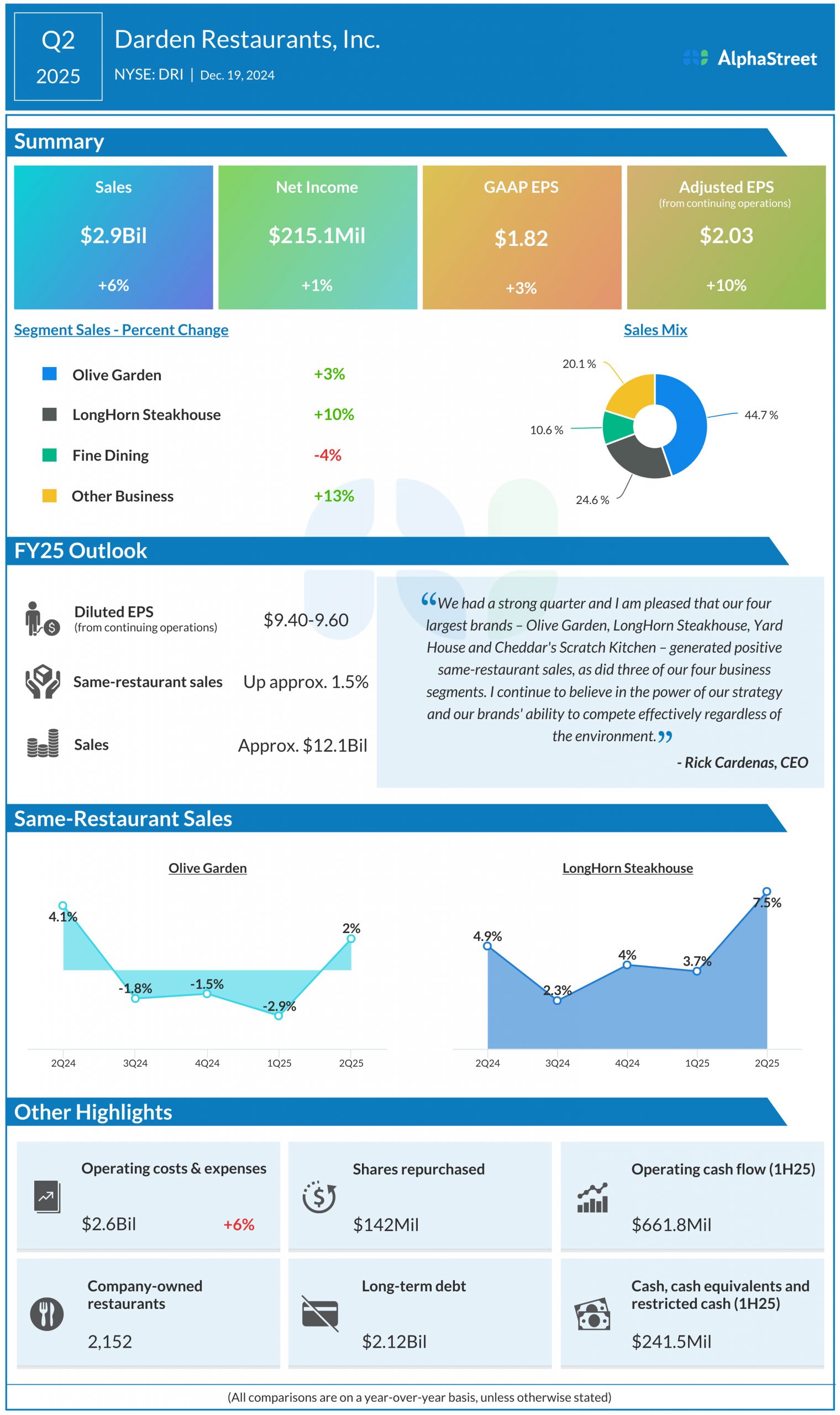

Darden Restaurants (DRI): A look at the restaurant chain’s performance in Q1 2026

Shares of Darden Restaurants, Inc. (NYSE: DRI) were down over 2% on Friday. The stock has dropped 17% year-to-date. The restaurant operator delivered sales and earnings growth for the first quarter of 2026 and updated its outlook for the full year. The company benefited from positive same-restaurant sales across most of its segments. Here’s a … Read more

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content