Strategy Chairman Michael Saylor pushed back on Friday against fresh claims that his company had reduced its bitcoin holdings.

The talk began when X user Walter Bloomberg highlighted Arkham data showing what looked like a drop in Strategy’s wallets, from about 484,000 BTC to roughly 437,000 BTC.

$MSTR – ARKHAM: SAYLOR’S STRATEGY CUTS BITCOIN HOLDINGS BY 47K

Arkham data shows Michael Saylor’s Strategy (MSTR) reduced its Bitcoin holdings from 484,000 to about 437,000, a drop of roughly 47,000 BTC. It’s unclear whether this came from transfers or sales. This is the first…

— *Walter Bloomberg (@DeItaone) November 14, 2025

Bloomberg reported it was unclear if the shift came from internal transfers or actual sales, noting it would be the first recorded decrease since July 2023.

The post spread quickly, and Saylor responded soon after.

DISCOVER: 10+ Next Crypto to 100X In 2025

Could Strategy’s New Stock Offering Add Thousands More BTC?

Speaking on CNBC, the Strategy co-founder dismissed the reports and said the company has not changed its long-term view, even as the market continues to slide.

We are ₿uying.pic.twitter.com/6g11E9G6pO

— Michael Saylor (@saylor) November 14, 2025

“We are buying. We’re buying quite a lot, actually, and we’ll report our next buys on Monday morning. I think people will be pleasantly surprised,” Saylor said during the interview.

Arkham pushed back on Bloomberg’s report, saying Strategy often shifts its wallets and custodians.

Strategy regularly undergoes wallet/custodian rotations.

Most of the movements that have been reported this morning appear to be a continuation of those transfers.https://t.co/CSsqSiCLHH

— Arkham (@arkham) November 14, 2025

The firm added that the movements seen earlier in the day were likely part of those routine transfers.

A Nov. 10 filing with the US Securities and Exchange Commission shows Strategy bought 487 BTC for about $49.9M, bringing its total to 641,692 BTC.

DISCOVER: Best New Cryptocurrencies to Invest in 2025

MSTR Price Prediction: Could MSTR Rebound Toward $260 Before Falling Lower?

Bitcoin slipped below $97,000 on Friday as the market’s downturn from the previous day continued to drag prices lower.

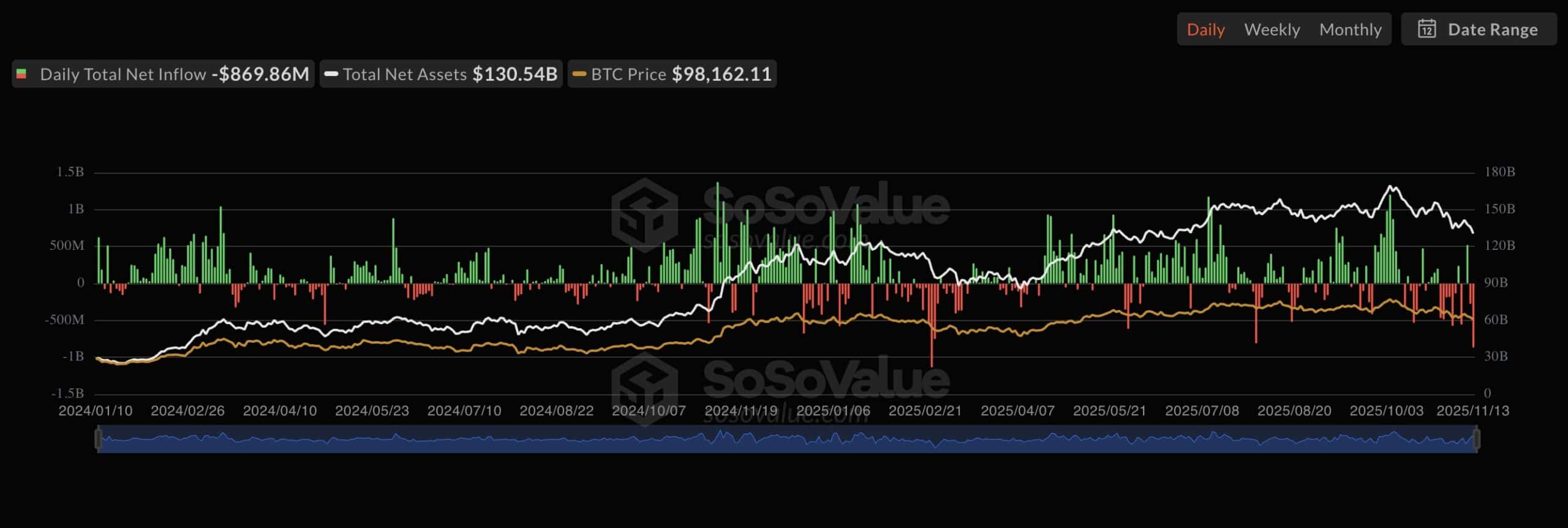

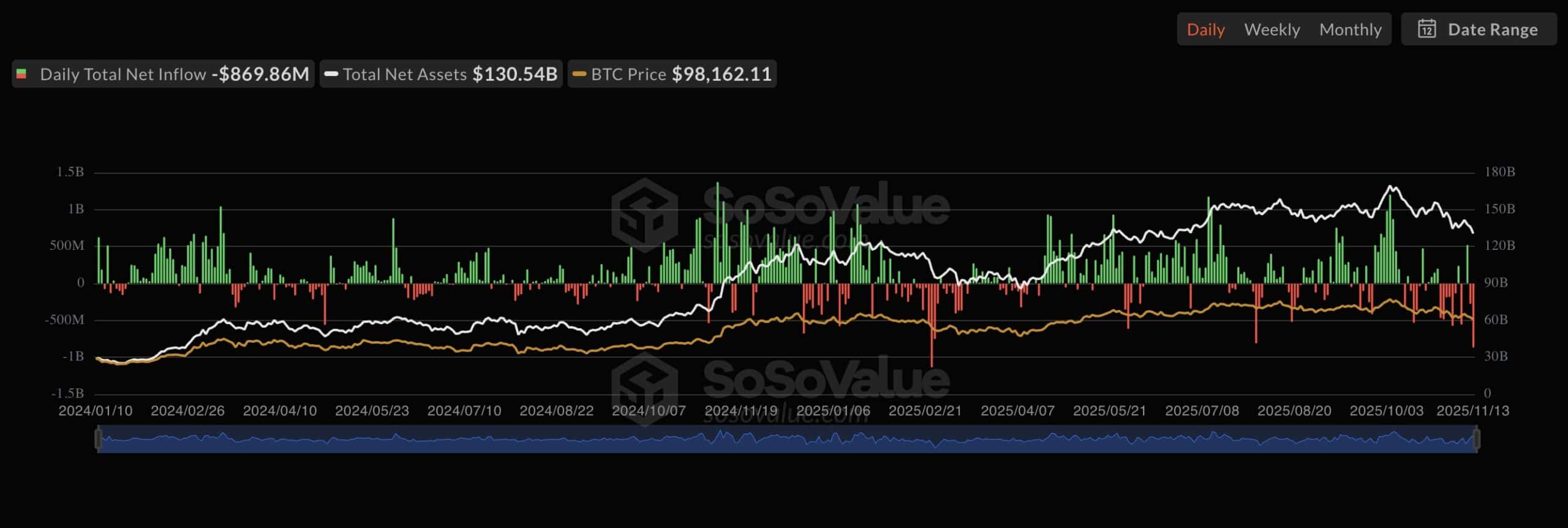

As per SoSoValue data, Spot Bitcoin ETFs saw about $869M in outflows, marking the second-largest withdrawal on record.

MicroStrategy (MSTR) stock was down about -2.2% to $203.79 at the time of publication and has fallen roughly 18% over the past five days.

Ali Martinez, a crypto analyst, posted Strategy Inc.’s weekly chart, which shows a clear fractal echo of the 2021–2022 breakdown. In both periods, the price lost a major horizontal support level and then dropped sharply.

The current move reflects that same structure, with MSTR breaking below the $245 area and continuing to move lower. The chart points to a possible short-term rebound toward $260, similar to the relief move shown in the earlier shaded section. But the wider trend still looks weak. If this pattern continues tracking the previous cycle, the next major drop could push the stock toward the $120 zone.

Merlijn The Trader, a prominent crypto trader, noted that Bitcoin and MicroStrategy now show the same weekly structure.MicroStrategy slipped below its 50-week moving average after a firm rejection, which sparked a sharp sell-off.

Bitcoin is now back at a key point on the chart, sitting right on its 50-week moving average after several failed attempts to hold above it.

Recent candles show fading strength, with lower highs and steady pressure building along the trend line.

A clear break below this level would signal that long-term support has slipped. That would raise the risk of a sharper correction.

The analyst says that if this line gives way, the market should be ready for a heavier downside.

EXPLORE: What is Liquid Staking & How Does it Work?

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content