As we wait for the FOMC meeting on Wednesday 10 at 2 p.m. ET and the market’s potential reaction to possible rate cuts, let’s dive into Aster DEX and its price prediction.

Aster has become a key player in the perp trading space since its launch earlier this year. Built on BNB Chain with multi-chain support, it allows users to trade perpetuals and spot markets using yield-bearing collateral like asBNB. The ASTER token powers fees, governance, and rewards.

Recent moves, such as burning 77.86M tokens worth $79.81 million from S3 buybacks, show a strong commitment to reducing supply. As S4 buybacks ramp up tomorrow with $4 million in daily injections, the token sits at $0.952 on strong support.

This Aster price prediction leans toward a rebound if macro conditions ease, targeting $1.20 short-term and $2 by Q1 2026.

EXPLORE: 10+ Next Crypto to 100X In 2025

Aster’s Core Build: CZ Backing and BNB Synergy

Aster started as a merger between Astherus and APX Finance in late 2024. It rolled out as a decentralized perp exchange focused on low fees and fast execution across chains like Solana, Ethereum, and Arbitrum. Traders can earn yields on collateral while opening positions, which sets it apart in DeFi. The platform hit $238 billion in volume in the last 30 days, with over 200,000 holders. Plans for its own Layer 1, Aster Chain, are set for full deployment this quarter, aiming to cut reliance on external L2s.

CZ’s involvement adds some weight. In early November, the former Binance CEO bought $2 million in ASTER tokens at around $1.25, sparking a 35% pump. He now holds over $2.5 million worth and promotes it across his channels, calling it a boost for BNB ecosystem growth. CZ clarified Aster runs independently but aligns with BNB’s multi-chain push. This tie-in drives liquidity from Binance users, with Aster allocating 53.5% of tokens to community rewards versus competitors’ lower splits. Daily fees, now at 70-80% for buybacks, fund ongoing repurchases.

S4 kicked off three days ago, already snapping up 8.81 million ASTER for 9.13 million USDT at an average $1.036. Tomorrow’s acceleration to $4 million daily could tighten supply further, especially after S3’s half-burn.

— Aster (@Aster_DEX) November 20, 2025

The community feels this momentum. With CZ’s public nods, holder count climbed 15% last month. This base positions Aster to capture more perp volume as DeFi TVL rebounds.

DISCOVER: Blackrock Files For Ethereum Staking ETF: Will Latest Blackrock News Catalyse $5,000 ETH USD Price?

Selling Pressure vs. Burns: How Aster Is Fighting Its Downtrend

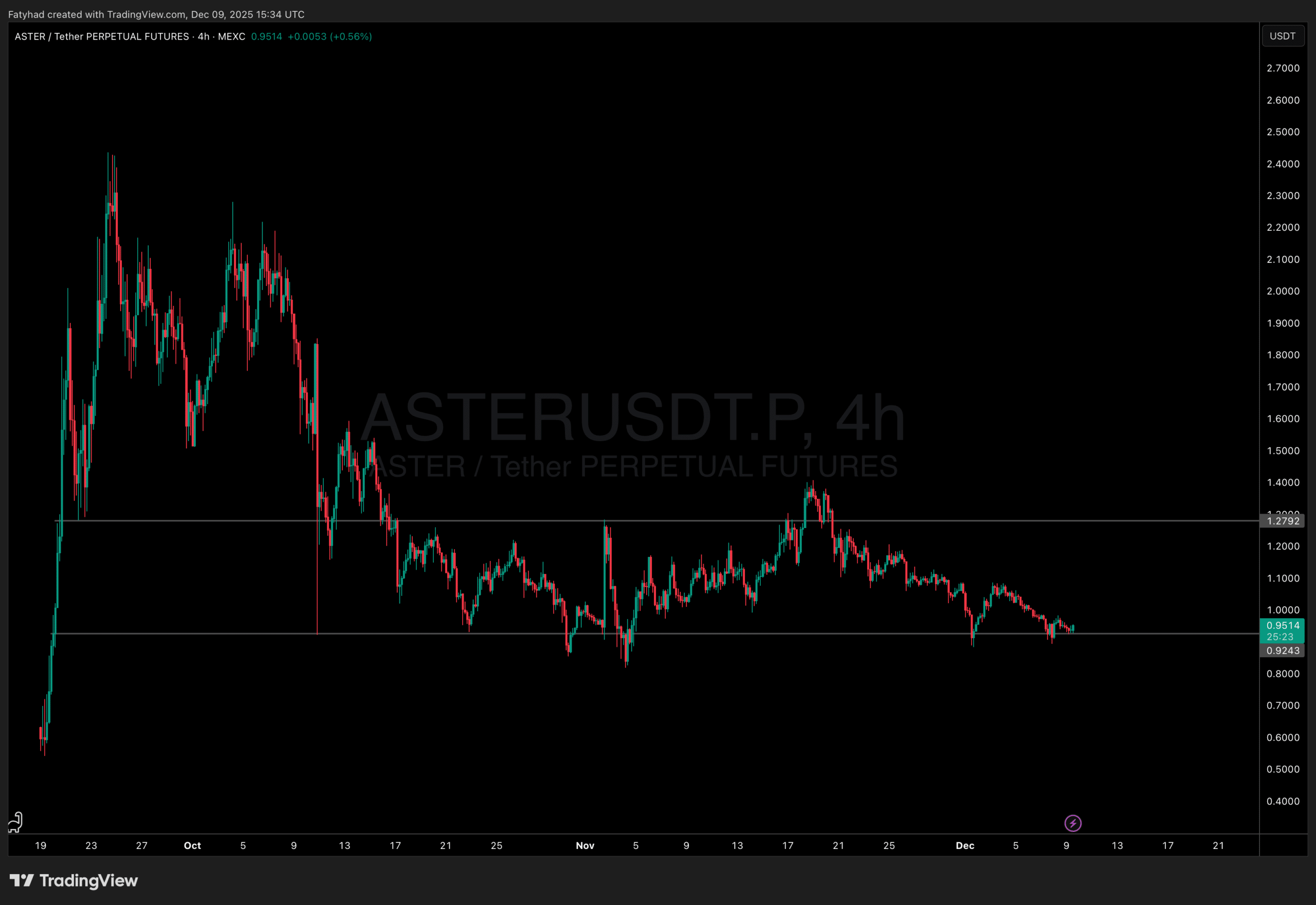

Price action tells a tough story. From October highs near $2.50, ASTER slid 62% into December, testing $0.90-$0.92 support multiple times. The 4-hour chart displays steady red candles, with volume surging on dips. Broader market weakness, tied to BTC’s range-bound grind below $90,000, amplified the drop. Yet, key levels held, like the $0.92 zone, acting as a demand floor.

(Source: Coingecko)

Selling pressure stems from unlocks and early exits. Season 3 rewards distributed 50 million tokens last month, hitting liquidity pools and sparking sales. Whales offloaded 20 million ASTER in November, per on-chain data, keeping upward moves capped. Macro factors, like delayed rate cuts, added drag. But burns counter this.

The recent 77.86 million token torch, valued at $79.81 million, reduced the circulating supply by 7.8%. S4’s ongoing wallet has locked another 8.81 million, with more inbound.

Traders watch closely. Aster’s fee structure helps: 60-90% of daily revenue goes to repurchases, up from 50% in S3. This created short-squeeze potential last week, when the price rebounded 12% after dipping to CZ’s entry cost. Volume metrics improved too, with perp trades outpacing spot 3:1.

If S4 completes by Wednesday, as planned, another 100 million tokens could face the burn, easing pressure long-term.

EXPLORE: 16+ New and Upcoming Binance Listings in 2025

Aster Price Prediction: Buybacks vs. Hyperliquid Edge

The perp DEX race heats up, pitting Aster against Hyperliquid. Hyperliquid leads with 4.1% market visibility and deeper liquidity, thanks to on-chain matching on its custom chain. It processes 2x Aster’s daily orders but lags in community allocation. Aster flipped it on fees and volume in late September, generating more revenue than Circle at one point. New rivals like Lighter join the fray, but Aster’s multi-chain setup and CZ boost give it crossover appeal.

Aster has grown faster than almost anyone. Also, it has completed a 155.72M ASTER buyback, burning half and using the rest for long-term rewards.

Key numbers:

▸ $3.5T+ total volume

▸ 31% of all perp DEX activity in November

▸ 400K new traders since October

▸ Almost… pic.twitter.com/0A6smZiDeQ— ZYN (@Zynweb3) December 9, 2025

Can Aster win? It depends on execution. Hyperliquid’s speed edges out in high-vol environments, but Aster’s yield collateral draws passive traders. With $6 billion in volume, Aster closed the gap to 20% behind. Launching Aster Chain could match Hyperliquid’s infra, cutting latency 30%. Community focus, 53.5% token drop, builds loyalty, unlike Hyperliquid’s 31% airdrop.

This Aster price prediction factors in S4 buybacks as the catalyst. If $4 million daily holds support at $0.92, we could expect a push to $1.20 by mid-December.

Longer view: $2–$3 in 2026 if volume holds and burns continue, potentially outpacing Hyperliquid on fees. Risks include macro-driven sell-offs, with a possible retest of $0.90 or lower if that level fails to hold.

Traders eye tomorrow’s buyback pulse, it could mark the downtrend’s end.

Key Takeaways

-

Aster’s aggressive S4 buybacks and major token burns are tightening supply and supporting a potential price recovery. -

Market sentiment improves as BTC stabilizes and Aster’s volume, community growth, and CZ backing reinforce long-term resilience.

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content