The crypto market continued to decline on Thursday and today, October 17, following renewed global uncertainty after former U.S. President Donald Trump’s comments about imposing 100% tariffs on Chinese imports. The threat of trade disruption pushed investors toward defensive assets, weighing on both equities and digital currencies. With market sentiment sinking, traders are now questioning whether this correction could present the best crypto to buy opportunity before year-end.

Total crypto market capitalization fell 4.67% to $3.61 trillion, while the CMC20 Index dropped 5.4%. Bitcoin

2.14%

traded near $104,900, down 5.3% in 24 hours and 12.18% over the week. Ethereum

2.55%

slipped below $3,700, while Solana

4.47%

now at $176,

2.78%

, and Cardano

3.25%

each declined between 7% and 9%.

The Crypto Fear & Greed Index dropped to 28 (“Fear”), signaling weakened sentiment. The average crypto RSI of 35.88 also points to oversold conditions across major assets.

EXPLORE: Top 20 Crypto to Buy in 2025

Gold Extends Record Rally as Investors Shift to Safe-Haven Assets

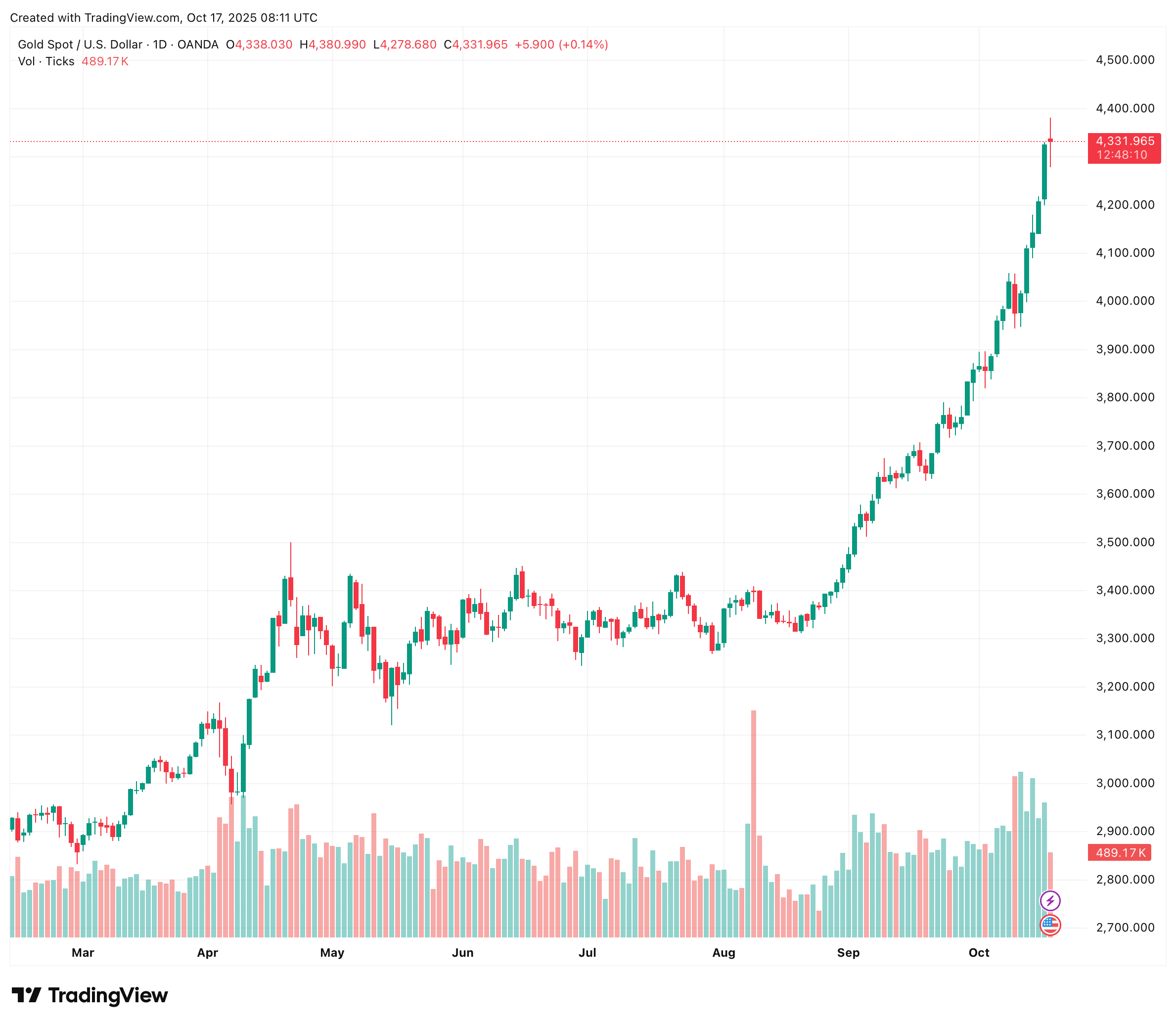

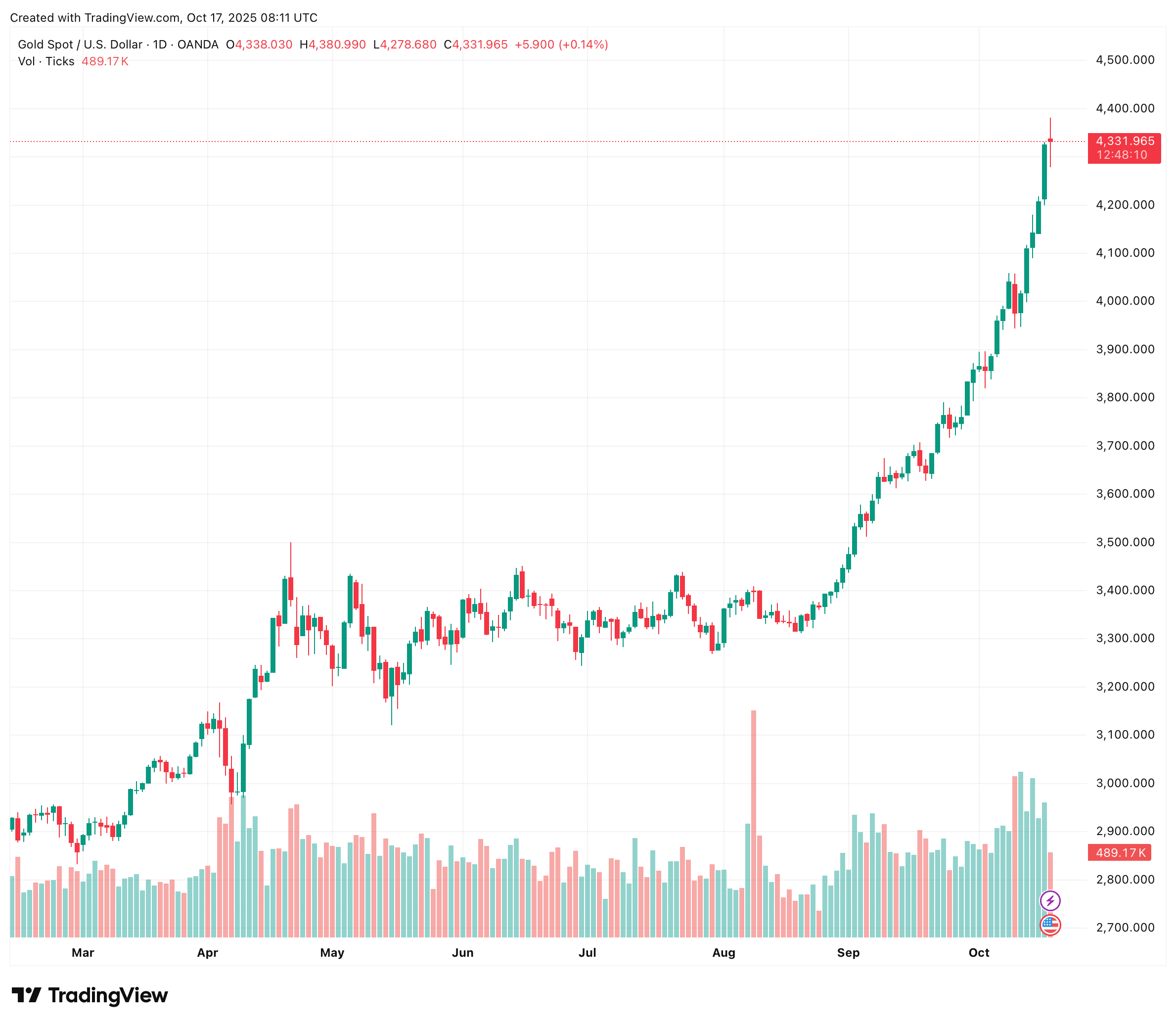

Gold prices continued their record-breaking climb for a fourth consecutive day on Thursday, October 16, as traders moved away from risk assets amid escalating U.S.–China trade tensions and growing fears of a U.S. government shutdown. Spot gold surged 3% to $4,380 per ounce.

(Source: TradingView)

Gold has now gained more than 60% in 2025, supported by geopolitical uncertainty, expectations of Federal Reserve rate cuts, strong central bank demand, and a continued move toward de-dollarisation. Analysts attribute much of the rally to renewed safe-haven buying, with investors increasingly diversifying away from volatile equities and crypto assets.

Meanwhile, Washington’s criticism of China’s rare-earth export restrictions and Trump’s plan for another summit with Russian President Vladimir Putin added to geopolitical uncertainty. The U.S. Federal Reserve is now widely expected to cut rates twice before year-end, with October and December probabilities at 98% and 95%, respectively.

Reflecting the broad move into precious metals, silver rose 1.8% to US$54.04 per ounce, setting a new record at US$54.15, while platinum advanced 3.2% to US$1,706.65, and palladium jumped 4.6% to US$1,606.00.

DISCOVER: Why Is Crypto Crashing? Did Robinhood Just Mark the End of the Cycle?

ETF Outflows Raise Caution, Traders Ask: What’s the Best Crypto to Buy Now?

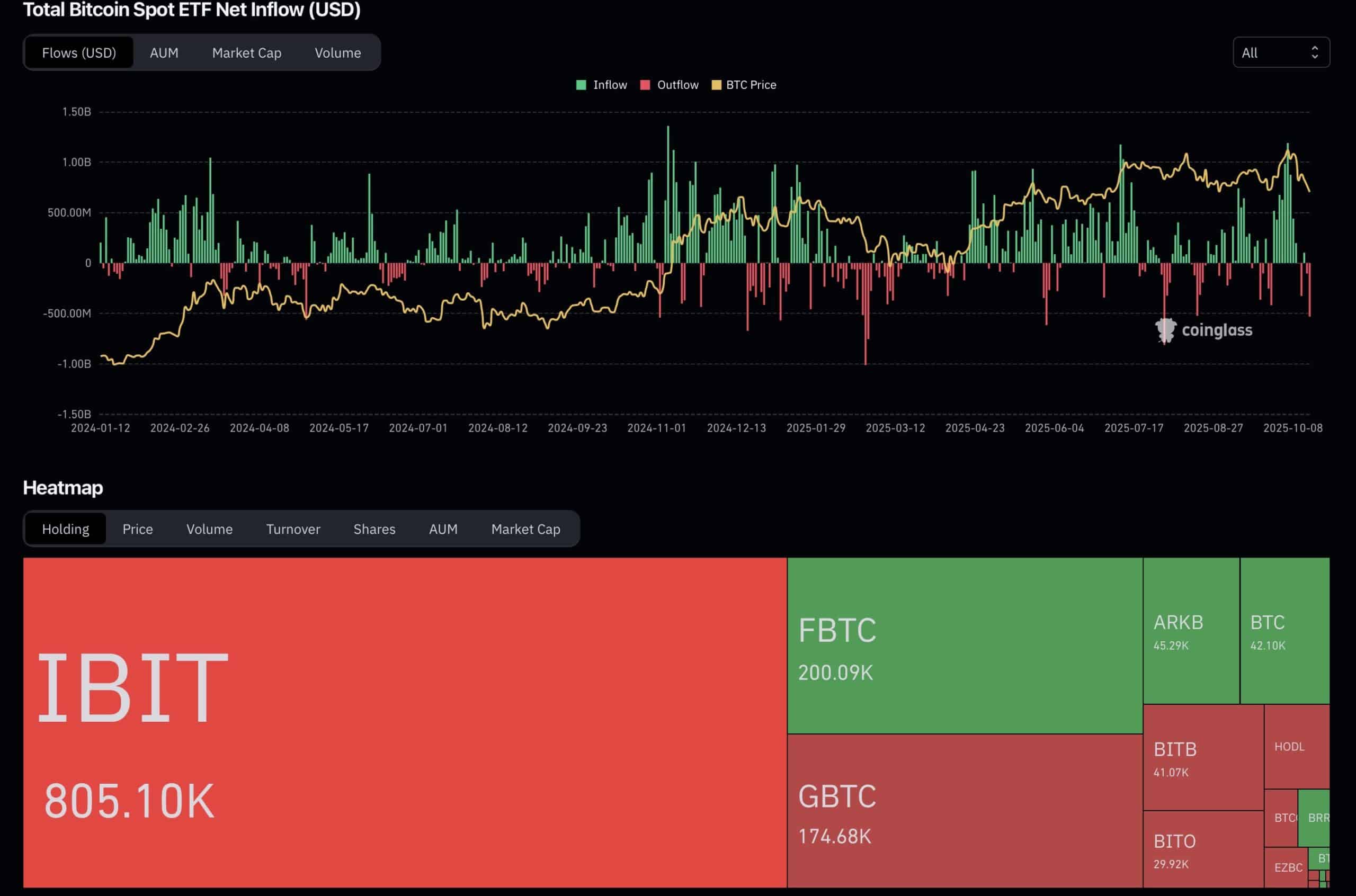

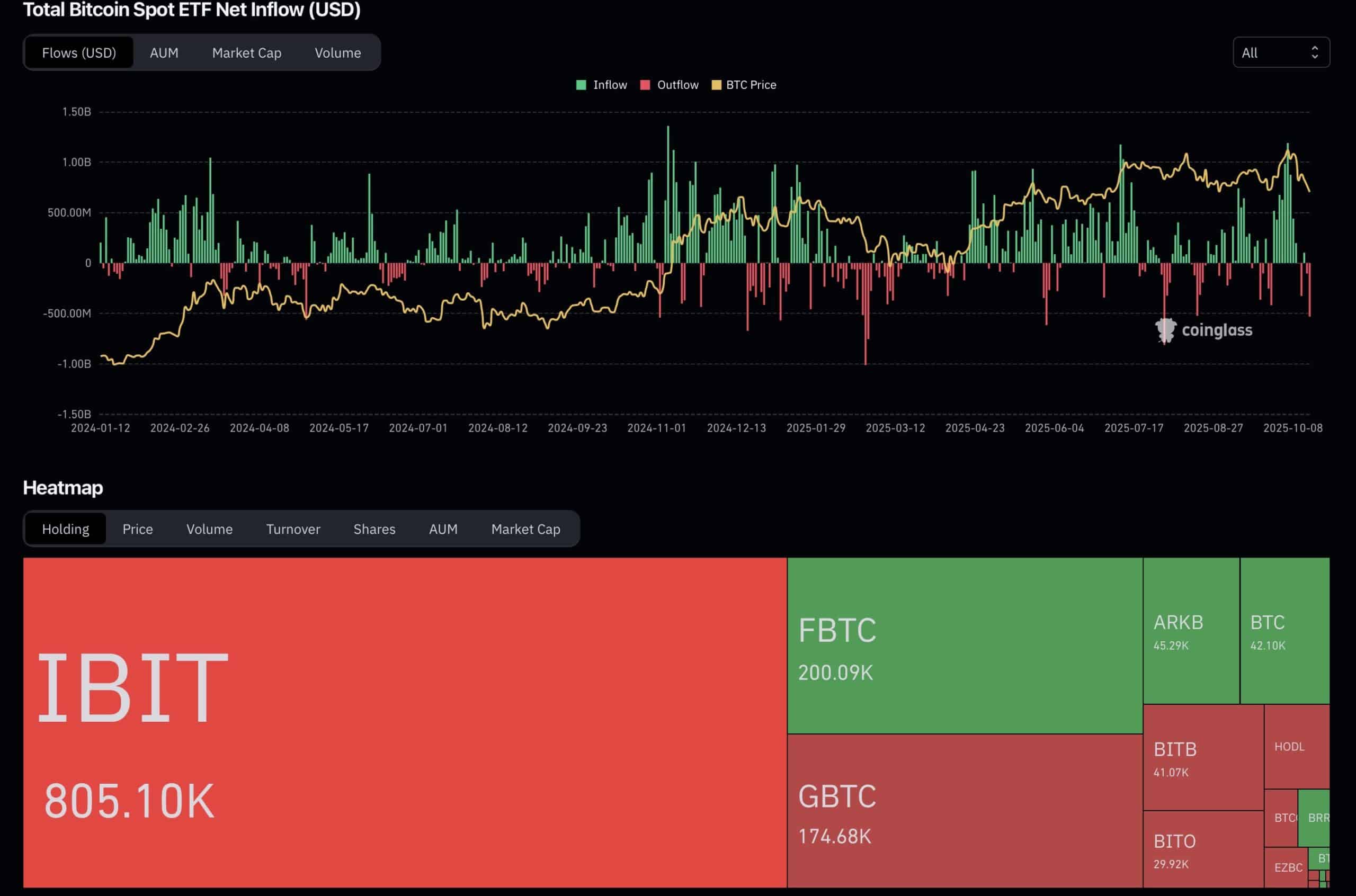

On October 16, U.S. spot Bitcoin ETFs reported $536 million in net outflows, the largest single-day withdrawal since August. None of the twelve funds recorded inflows, while Grayscale’s GBTC and Fidelity’s FBTC led redemptions. Spot Ethereum ETFs saw $56.88 million in outflows, with BlackRock’s ETHA the only one to post a small inflow.

Bitcoin is now testing key support near $104,000, a level that previously triggered $2.1 billion in liquidations. The ongoing correction reflects a combination of trade-related anxiety, institutional withdrawals, and derivatives pressure.

While sentiment remains weak, analysts are watching whether ETF flows stabilize and if current prices could represent long-term accumulation zones.

For investors assessing opportunities amid fear, upcoming sessions may help identify the best crypto to buy as market volatility settles.

There are no live updates available yet. Please check back soon!

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content