Federal Reserve Chairman Jerome Powell said on Tuesday that the U.S. central bank may soon reach the end of its balance sheet reduction program. However, Bitcoin

1.08%

continued to trade lower around $112,600, extending its weekly decline by more than 7%. The weakness in BTC has led traders to look for the best altcoins to buy, as capital begins rotating toward smaller and more active tokens.

The Federal Reserve’s quantitative tightening, which began in 2022, has reduced the balance sheet from $9 trillion to $6.6 trillion.

Our plan is to stop balance sheet runoff when reserves are somewhat above the level we judge consistent with ample reserve conditions

Powell said during his speech at the National Association for Business Economics conference in Philadelphia.

He added that the Fed could reach that point “in the coming months,” as policymakers monitor liquidity conditions and short-term funding rates. The QT program, launched in 2022 to unwind the stimulus from the COVID-19 era, has already reduced the Fed’s holdings by $2.4 trillion.

Altcoins Hold Ground As Bitcoin Weakens — Best Altcoins To Buy

Despite the cautious macro backdrop, several altcoins are showing relative strength. Solana

5.25%

rose 6.4% in the past 24 hours to around $207, while Dogecoin

2.74%

gained over 4%.

2.06%

rebounded from the $2.40 support zone, where buyers continue to defend against further downside.

According to CoinMarketCap data, the global crypto market cap stands at $3.79 trillion. The Fear and Greed Index remains in the “fear” zone at 37, while the average crypto RSI of 48.1 suggests the market is near oversold territory.

Crypto Fear and Greed Chart

All time

1y

1m

1w

24h

EXPLORE: 15+ Upcoming Coinbase Listings to Watch in 2025

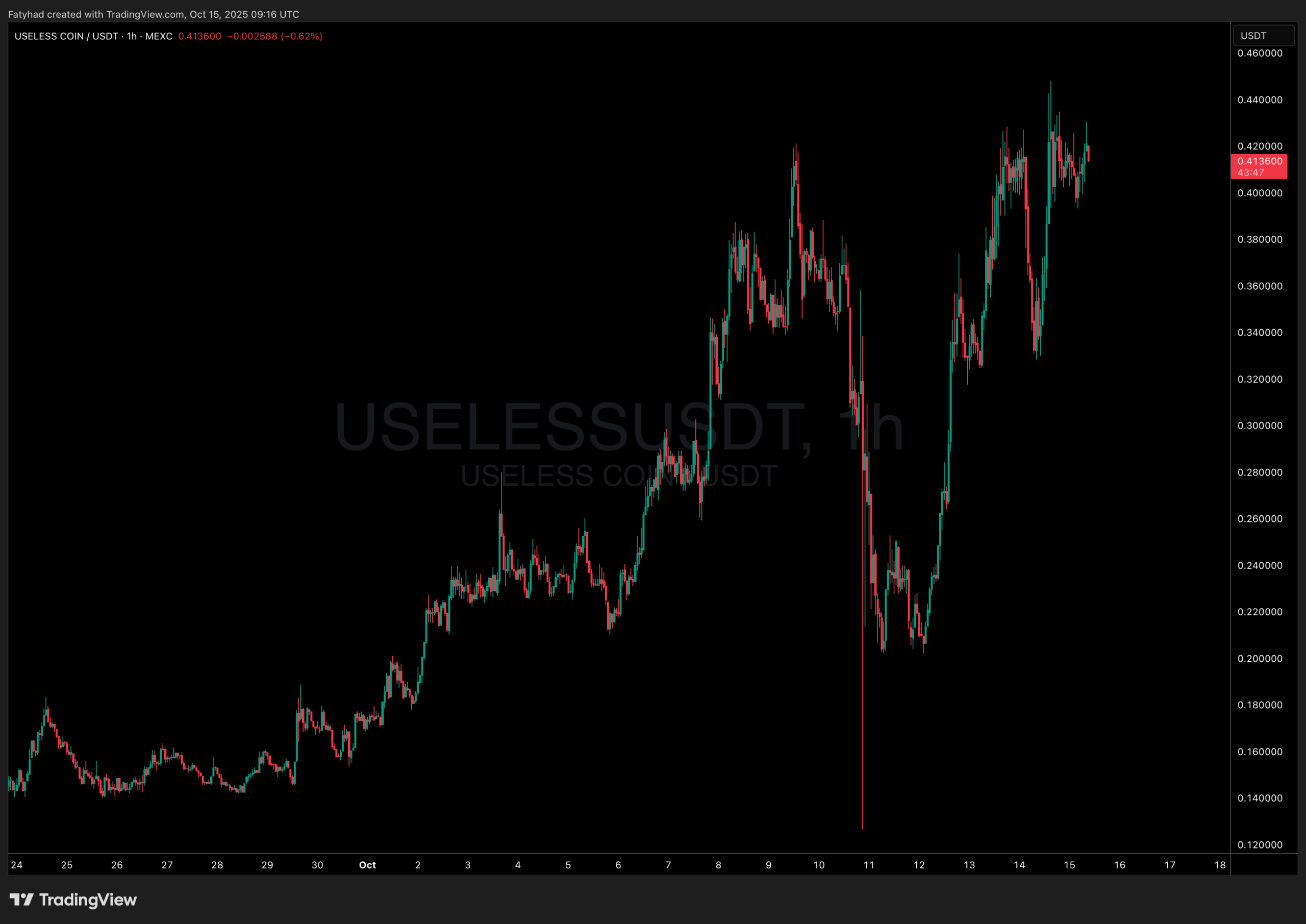

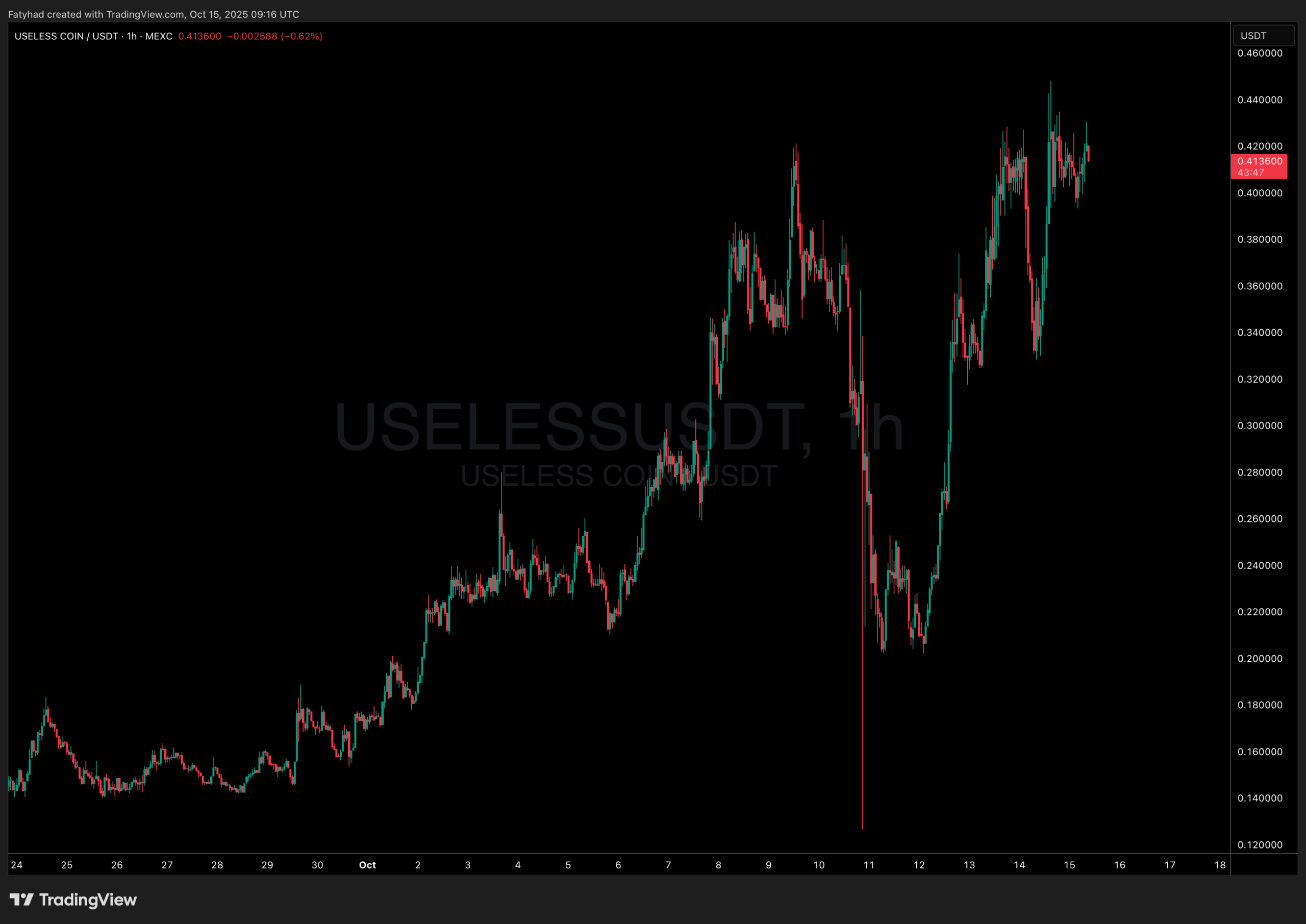

Among altcoins, ZORA, COAI, and

11.43%

have stood out with notable resilience. ZORA and USELESS each gained about 20% in the past day, with USELESS hitting a new all-time high and now trading at $0.41.

(Source: Coingecko)

COAI, the AI-linked token, has shown extreme volatility — recently jumping from $7.46 to $44 before correcting to around $15.96.

The contrast between Bitcoin’s consolidation and these smaller-cap gains suggests traders are positioning for potential altcoin outperformance.

If the Fed confirms the end of quantitative tightening later this year, improving liquidity conditions could favor coins like SOL, XRP, and fast-rising meme tokens such as ZORA, COAI, and USELESS — some of the best altcoins to buy for Q4 2025.

CZ Responds to Listing Fee Complaints: “Focus on Building, Not Blaming”

Binance founder Changpeng Zhao (CZ) shared his take on the recent debate over exchange listing fees, calling out projects that complain about “fees” or airdrop requirements. His advice was simple: don’t pay them.

“If your project is strong, exchanges will race to list your coin,” CZ said, adding that those begging for listings should reflect on who’s really providing value.

He also dismissed complaints about competitor policies: “In a decentralized world, every exchange can choose its own model. Focus on your users, not your rivals.”

CZ outlined three main listing approaches — open listing (high risk of scams), paid listings for revenue, and selective listings with user airdrops or security deposits to filter low-quality projects.

His closing message to frustrated investors was clear: “If you’re holding a bag, complain to the project, not the exchange — or just use a DEX.”

Inside Japan’s Plan To Take Down Insider Trading: Is This The End of Crypto Manipulation?

The top financial watchdog in Japan is preparing a set of new rules to ban insider trading in cryptocurrencies.

According to an article published by Nikkei Asia on 15 October 2025, the government will give the Securities and Exchange Surveillance Commission (SESC), authority to investigate suspicious trades and recommend penalties or criminal charges when trades are based on undisclosed information.

So far, Japan’s insider trading laws have not covered crypto assets, which fall under the Financial Instruments and Exchange Act (FIEA).

Read The Full Article Here

Coinbase to Invest in CoinDCX at $2.45B Valuation, Highlighting India’s Growing Role in Global Crypto Market

Coinbase has entered into an agreement to invest in CoinDCX, valuing the Indian crypto exchange at $2.45 billion post-money, pending regulatory approval. The partnership underscores confidence in CoinDCX’s long-term strategy, regulatory-first approach, and the rising importance of India and the UAE in the global crypto landscape.

As CoinDCX enters its next phase of growth, it plans to focus on expanding crypto adoption, developing new on-chain applications, and promoting transparency and compliance across the industry.

The company also aims to enhance crypto education, enabling more users to participate safely in the evolving digital economy.

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content