The market appears cautious today, with total capitalization close to $3.2 trillion as the Federal Open Market Committee (FOMC) begins its two-day meeting.

0.63%

, after scaling $92,000 yesterday, dipped below $90,000 before stabilizing. It currently sits at $90,370, up 0.5% over 24 hours amid persistent volatility, leaving traders scanning the market for the next crypto to explode as sentiment shifts.

0.48%

trades above $3,116, down 0.3%, though supported by significant whale activity. Most altcoins mirror the downturn with 24-hour losses between 0.8% and 2.3%, while standouts like Zcash (ZEC) post gains. Another rotation toward privacy coins?

Intrigue also grows around the so-called “Trump Tariff Whale,” who previously pocketed $192 million shorting BTC and ETH ahead of tariff news and is now long $196 million on ETH with 5x leverage on Hyperliquid, currently showing $5 million in unrealized profit. This move reflects renewed conviction in Ethereum’s supply squeeze and staking economics heading into 2026.

EXPLORE: 20+ Next Crypto to Explode in 2025

ZEC Turns Green Again – Is a Privacy Coin the Next Crypto to Explode?

The move echoes a similar pattern seen a few weeks ago when Bitcoin fell below $82,000, prompting capital to rotate into privacy names.

16.84%

gains traction at $406, up 18% weekly, as traders speculate whether a weakening Bitcoin and renewed market uncertainty could lift privacy-focused tokens once more.

The FOMC meeting kicks off today, December 9, with the rate announcement expected tomorrow. Markets are pricing in an 85–87% chance of a 25-basis-point cut to 3.50%–3.75%, responding to easing inflation (now around 2.9%) and a cooling labor market. This would mark the third reduction this year.

Rate cuts aim to spur economic growth by making borrowing cheaper, lifting spending, investment, and hiring to counter slowdown risks. Historically, they weaken the dollar (boosting exports and commodities) but can reignite inflation, especially amid fiscal shifts such as potential tariff changes. For equities, cuts often spark rallies by improving corporate profitability and driving flows from bonds (whose yields fall) into stocks, particularly tech.

DISCOVER: Stable Crypto’s Disastrous Launch Leaves Room for Bitcoin Hyper to Take the Spotlight

In crypto, a brief “sell the news” dip may follow if cuts signal economic fragility, though over time, abundant liquidity typically supports digital assets.

Lower yields position Bitcoin and Ethereum as hedges against dollar weakness, mirroring dynamics from 2020 when aggressive easing propelled BTC from $7,000 to $28,000. Recent cuts similarly helped drive Bitcoin toward $90,000 on institutional inflows, though volatility remains elevated around policy decisions—making Jerome Powell’s guidance crucial.

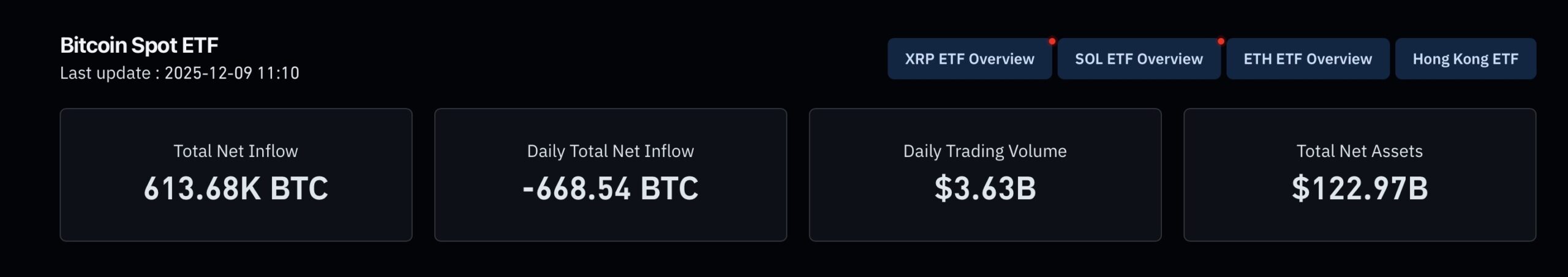

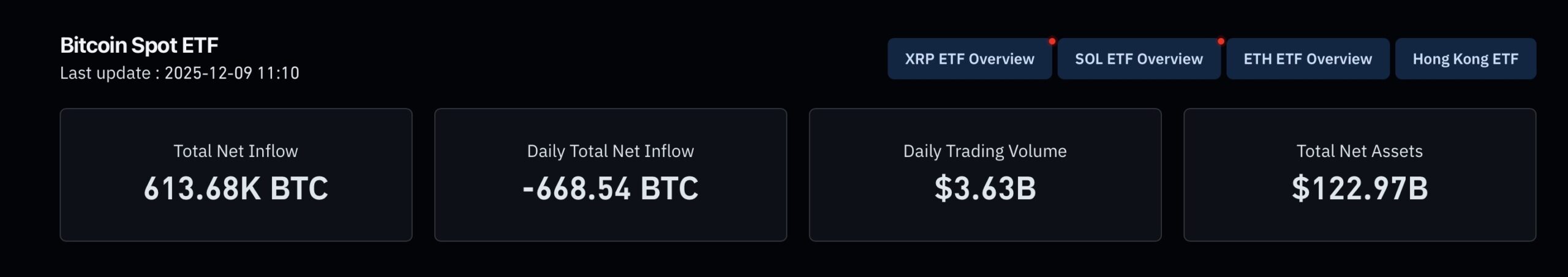

Monday’s U.S. spot Bitcoin ETFs posted $60.5 million in net outflows, highlighting institutional caution, contrasted by steady inflows into Ethereum products.

With the FOMC meeting underway, traders should brace for strong swings. While a rate cut could introduce short-term pressure, it may ultimately unlock liquidity-driven rallies and spotlight resilient sectors poised for momentum.

Coinbase Adds PLUME Crypto and JUPITER as Year-End Liquidity Tightens Across Crypto Markets

Coinbase just opened spot trading for Plume Crypto and Jupiter coin on December 9, giving both assets direct access to one of the world’s largest regulated exchanges. Trading for PLUME-USD and JUPITER-USD went live after 9 AM PT once liquidity thresholds are met.

Risk asset bros, we are so BACK.

Institutions will also receive full support through Coinbase Exchange, widening the distribution network at a moment when risk appetite is shifting across the crypto market.

Read the Full Article Here

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content