0.89%

has climbed from its dip to $84,000 and is now trading close to $87,000, drawing attention again from large investors and smaller traders looking for the next 100x crypto. Today’s rebound reflects rapid stabilization after Bitcoin briefly fell below $84,000 due to thin liquidity and nearly $1 billion in forced liquidations across leveraged positions.

By midday, BTC returned to the $86,500–$87,200 zone, roughly 3% above its intraday low. The move follows a tough November in which Bitcoin shed over $18,000 as ETFs saw record monthly redemptions of $3.47 billion, the worst since February.

Yet on-chain activity shows large holders quietly accumulating, while technical data highlights firm support near $86,000. Analysts believe Bitcoin could attempt a run toward $100,000 if December inflows reappear, especially with historical averages pointing to a 9.7% gain for the month.

Grayscale Research expects Bitcoin to set new all-time highs in 2026, pushing back against the widely held “four-year cycle” narrative. The firm said this cycle has not seen the usual parabolic surge driven by retail traders, with institutional inflows, potential rate cuts, and…

— Wu Blockchain (@WuBlockchain) December 2, 2025

EXPLORE: 10+ Next 100x Crypto to Buy

Traders Explore the Next 100x Crypto As Vanguard’s New Policy Signals a Major Shift for Traditional Finance

One of the main catalysts behind today’s recovery is Vanguard’s sweeping policy change. The $11 trillion asset manager announced that, starting December 2, it will allow clients to trade crypto ETFs and mutual funds, reversing years of exclusion. This includes products tracking Bitcoin, Ether, XRP, and Solana, opening access to more than 50 million customers. Vanguard cited improved administrative frameworks and shifts in investor behavior, even as the crypto market has declined by $1 trillion since October. The change could introduce new capital into Bitcoin ETFs, which collectively hold $113 billion, offering potential relief from recent outflows and supporting price stability.

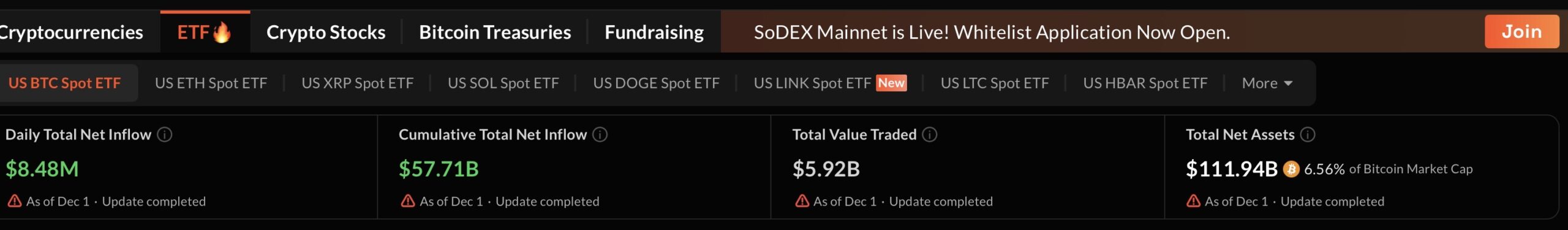

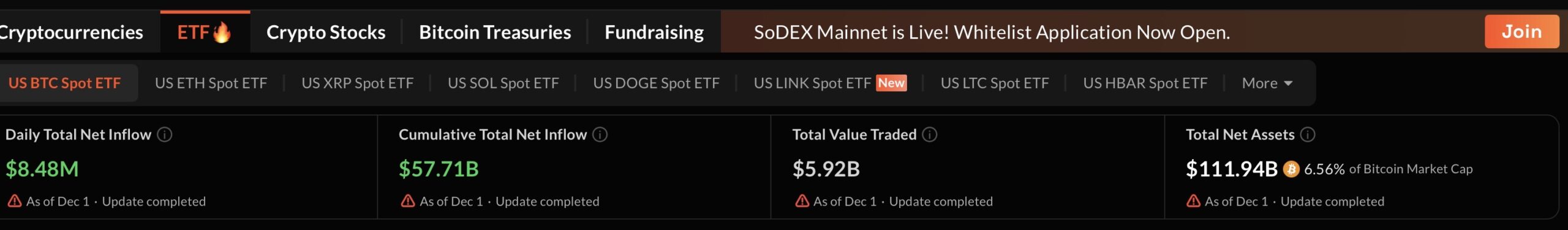

ETF activity remains crucial, with spot Bitcoin funds experiencing heavy withdrawals in November but now showing early signs of levelling off.

BlackRock’s IBIT, currently the largest with $70 billion in assets, recently increased its internal allocations, contributing to today’s rebound. Meanwhile, the Federal Reserve’s decision to end quantitative tightening, pausing its $2.2 trillion reduction in balance-sheet assets, eases liquidity constraints: conditions that often benefit assets like Bitcoin.

Additional movements include Coinbase’s Q4 index update, adding HBAR, MANTLE, VET, FLR, SEI, and IMX to track high-liquidity performers. Franklin Templeton also expanded its Crypto Index ETF to include Bitcoin, Ether, Solana, XRP, and several others, widening exposure for investors.

Altogether, Bitcoin’s rebound, Vanguard’s unexpected policy reversal, and the Fed’s liquidity shift create a constructive setup for the market. With traders monitoring both established assets and possible next 100x crypto opportunities, December could open the door to meaningful market progress.

DISCOVER: Vanguard Crypto ETF Greenlight Could End The Crypto Crash Today

There are no live updates available yet. Please check back soon!

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content