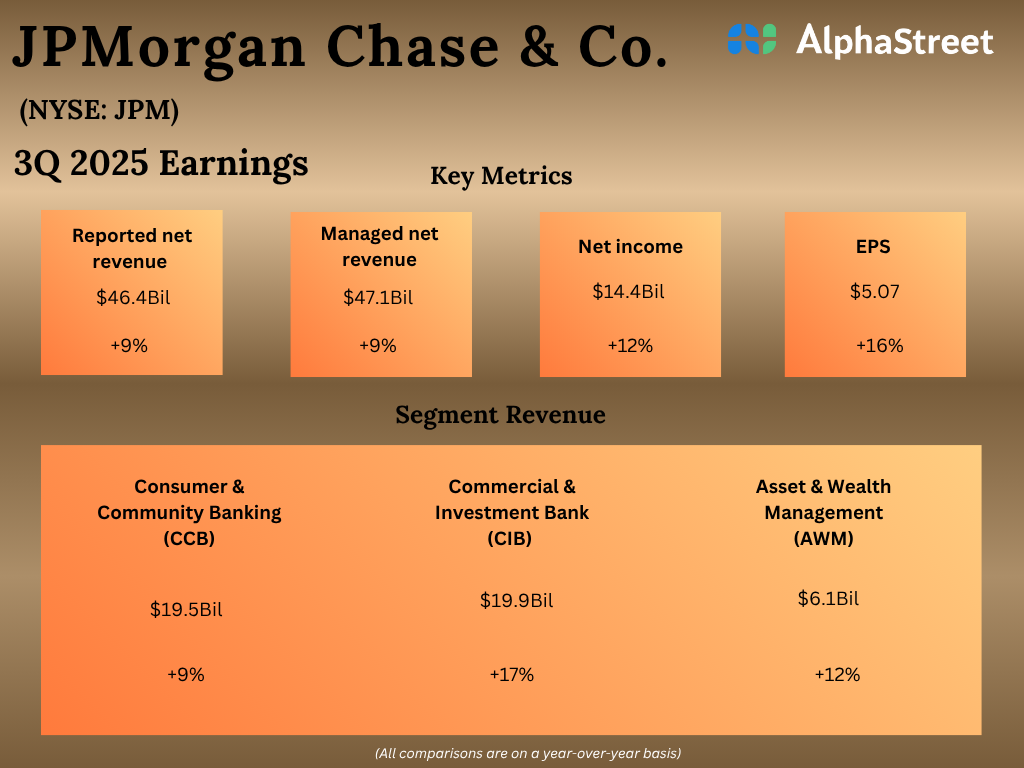

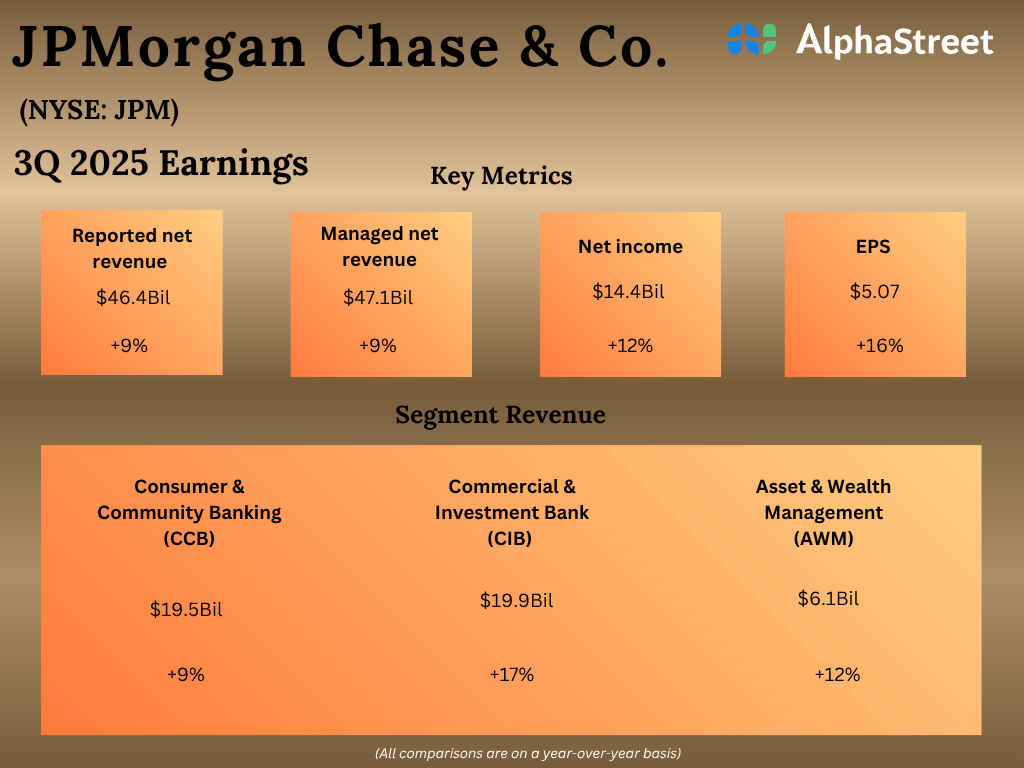

JPMorgan Chase & Co. (NYSE: JPM) reported its third quarter 2025 earnings results today.

Reported net revenue increased 9% year-over-year to $46.4 billion. Managed net revenue was $47.1 billion, up 9%.

Net income was $14.4 billion, up 12% from the prior year. Earnings per share rose 16% to $5.07.

Revenue and earnings beat expectations.

Net interest income, excluding Markets, was $23.4 billion, flat versus the prior year. Non-interest revenue, excluding Markets, was $14.8 billion, up 16% YoY. Non-interest expense was $24.3 billion, up 8% YoY.

“While there have been some signs of a softening, particularly in job growth, the US economy generally remained resilient. However, there continues to be a heightened degree of uncertainty stemming from complex geopolitical conditions, tariffs and trade uncertainty, elevated asset prices and the risk of sticky inflation.” – Jamie Dimon, CEO

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content