Whisper storming around Washington has pushed crypto market structure bill, or CMSB, discussions back into the space, and we can say that the timing couldn’t be more interesting. Democrats reportedly met privately to review Republicans’ compromise draft, just as we brace for a potential rate cut and renewed optimism from the latest Saylor and his Bitcoin buys.

BULLISH 🚨

U.S. REPUBLICANS AND DEMOCRATS MEET TODAY TO TALK ABOUT THE CRYPTO MARKET STRUCTURE BILL! pic.twitter.com/8l2OlSQPQk

— That Martini Guy ₿ (@MartiniGuyYT) December 9, 2025

With all these three themes now intersecting, policy, monetary signals, and big accumulation, the week opens with an unusually charged atmosphere for crypto.

A big part of the current excitement also stems from Strategy’s newest buy. The company led by Michael Saylor picked up 10,624 BTC for $962.7 million, pushing its total holdings to 660,624 BTC, as stated by Strategy’s Twitter account.

Strategy has acquired 10,624 BTC for ~$962.7 million at ~$90,615 per bitcoin and has achieved BTC Yield of 24.7% YTD 2025. As of 12/7/2025, we hodl 660,624 $BTC acquired for ~$49.35 billion at ~$74,696 per bitcoin. $MSTR $STRC $STRK $STRF $STRD $STREhttps://t.co/4rCL87nbYk

— Strategy (@Strategy) December 8, 2025

Why more buys from his end? Conviction. Considering their average cost basis of $74,696, the firm’s 2025 yield of 24.7% shows that conviction is paying off, something we all should learn from. And if we track his Bitcoin buying strategy, he rarely talks about timing the market, but recently he said,

“I think we are entering a bull market.”

Saylor’s continued accumulation adds weight to the CMSB conversation happening on Capitol Hill, where lawmakers weigh long-term crypto market structure decisions.

Crypto Technical Pictures Look Bigger Beyond CMSB Debate and Saylor Bitcoin Momentum

Bitcoin’s technicals are feeding into the bullish narrative. The weekly 36 level RSI hit only during the 2015 and 2018 bear markets, the Covid crash, and the 2022 downturn, has just reappeared during this 2025 correction. If we were to consider the history, this level precedes multi-year expansions, and many now argue that 2026 could mirror pasts rebounds.

(source – BTC USD, RSI, TradingView)

Meanwhile, BlackRock’s filing for a staked ETH ETF and the CFTC’s pilot program allowing Bitcoin as derivatives collateral further legitimize the market outside the typical regulatory chatter.

Even Henry Ford’s century-old comments about an energy-backed monetary system resurfaced online this week, with many noting how much his ideas resemble Bitcoin’s modern structure. Against the backdrop of CMSB negotiations, the historical parallel struck a chord with long-term crypto holders.

Henry Ford predicted Bitcoin 103 years ago 🤯 pic.twitter.com/fgjhk7hV1V

— Bitcoin Archive (@BitcoinArchive) December 8, 2025

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Rate Cut Expectations and Bitcoin Oddities

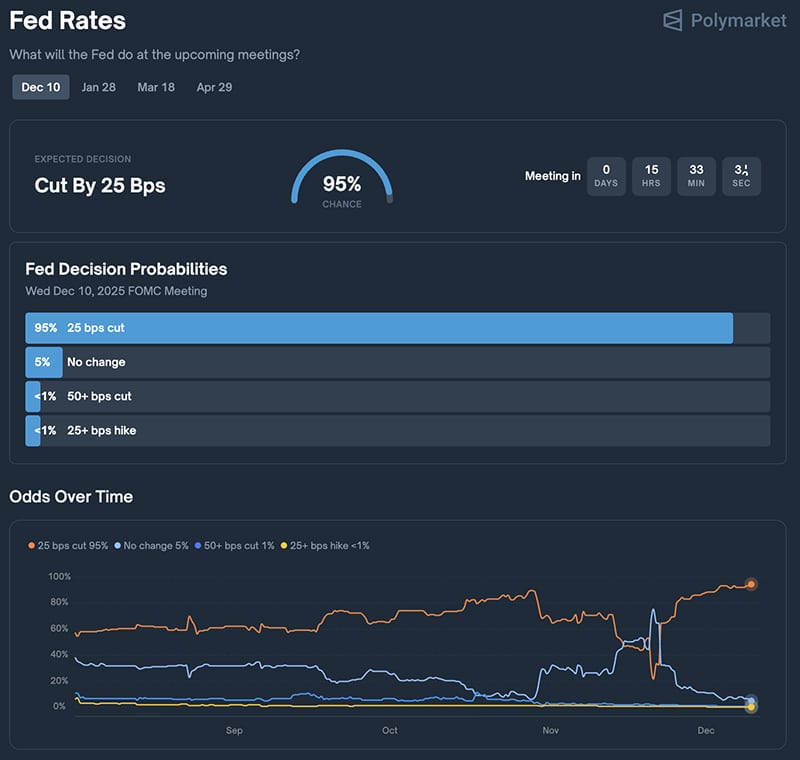

All eyes now shift to the Federal Reserve. Polymarket assigns more than 90% odds to a 25-basis-point Bitcoin rate cut, a third consecutive reduction. Standard Chartered echoes this outlook, and CME FedWatch sits near 87%.

(source – Polymarket)

Powell’s tomorrow press conference could shape risk appetite going into 2026, and a dovish dot plot may give Bitcoin a shot at reclaiming the $93,000 zone. If this and the regulatory clarity can lift each other, especially in line with the CMSB crypto bill, the impact could be huge for the market.

Yet one strange pattern persists: Bitcoin has peaked almost exactly when US markets open for five straight weeks. We just don’t buy the coincidence; the timing hints at coordinated suppression.

(source – TradingView)

But the combination of policy debates, a likely rate cut, and steady Saylor Bitcoin accumulation continues to define the most influential currents in today’s market.

DISCOVER: 10+ Next Crypto to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

SEC Ends 2 Year ONDO Crypto Investigation: Will CTFC Tokenized Collateral Pilot Trigger WAGMI?

After two years of waiting and wondering, the SEC has finally wrapped up its investigation into ONDO crypto. And, somewhat anticlimactically, nothing came of it. No charges, no settlement, no surprise.

The whole thing started back in 2024, mainly over whether ONDO, the crypto, works with tokenized real-world assets, especially treasuries, fit under existing securities rules, and if ONDO token itself should be treated as a security. At the time, regulators were cracking down on anything remotely tied to crypto, so ONDO ended up in the spotlight whether it wanted to be or not.

SEC spent 2 years sweating over @OndoFoundation tokenized T-bills, asking the classic “u a securities firm?? is ONDO a security??”

Final score: Ondo walks clean. No fines, no L’s – just a casual “yeah you’re chill bro.” 🥱 pic.twitter.com/bobOrU3wik

— Thesis.io (@thesis_io) December 9, 2025

Even with all those accusations, the company stuck to its guns. Its whole pitch has always been pretty simple: take assets people already understand, like treasuries and public equities, and put them on-chain without breaking the rules.

And what’s worth to be look at is that this “no news” conclusion from the SEC feels like a marker of how much the regulatory conversation has changed. Instead of defaulting to enforcement, regulators are finally open to updating the plumbing of the financial system. So, tokenized assets can fit into it without any other accusation.

Real-world assets (RWAs) — traditional assets such as U.S. Treasuries, money-market funds, private credit, and real estate that are represented onchain (“tokenized”) — bridge crypto and traditional finance.

The total market for tokenized RWAs sits at $30 billion, up nearly 4x in… pic.twitter.com/tQg2b96AJ2

— a16z crypto (@a16zcrypto) November 18, 2025

This shift is showing up elsewhere, too. The SEC is now actually talking to industry players instead of treating them like suspects. Also, global adoption of tokenized products keeps accelerating.

ONDO’s acquisition of Oasis Pro Markets didn’t make huge headlines, but it’s the sort of infrastructure move that shows tokenized treasuries and equities are not just experiments anymore, as they’re slowly becoming part of the real market stack.

Read the full story here.

ZCash, PEPE, and Monad Crypto Blast Off: Why?

The market is heating up again, and every trader wants to know which crypto to buy this week as volatility surges ahead of the December FOMC decision. With liquidity returning, meme coins stabilizing, and a high-performance L1 project showing signs of life.

Three crypto assets are standing out as top contenders for short-term momentum and long-term positioning. But with Bitcoin chopping under resistance and macro catalysts approaching fast, which of these tokens truly deserve your focus?

Read the full story here.

Will FOMC Trigger Parabolic QE Rally For XRP Price? Maestro Analyst Weighs In

The XRP price narrative is heating up again as markets brace for the pivotal FOMC meeting on December 9-10, 2025. With crypto trading sideways during a tense macro reset, many analysts believe XRP could be one of the biggest beneficiaries if the Federal Reserve confirms a dovish shift. After years of quantitative tightening, shrinking liquidity, and rising volatility in risk assets, traders are now watching for signs of renewed quantitative easing.

Such an event could ignite a powerful, liquidity-driven rally across the crypto market, and XRP, as one of the top-standing cryptos, would benefit massively. With its ETF approval a month ago, regulatory momentum, and a technical setup that some analysts describe as “primed for parabola,” this could happen sooner than everybody thinks.

Read the full story here.

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content