Tom Lee fans are jolting this week after the Fundstrat co-founder told a Binance Blockchain Week crowd that Bitcoin and the crypto market have already bottomed and that the next eight weeks could break the traditional four-year cycle. His remarks came just as Bitmine accumulation crossed another major milestone, with the firm scooping $131 million USD more in ETH.

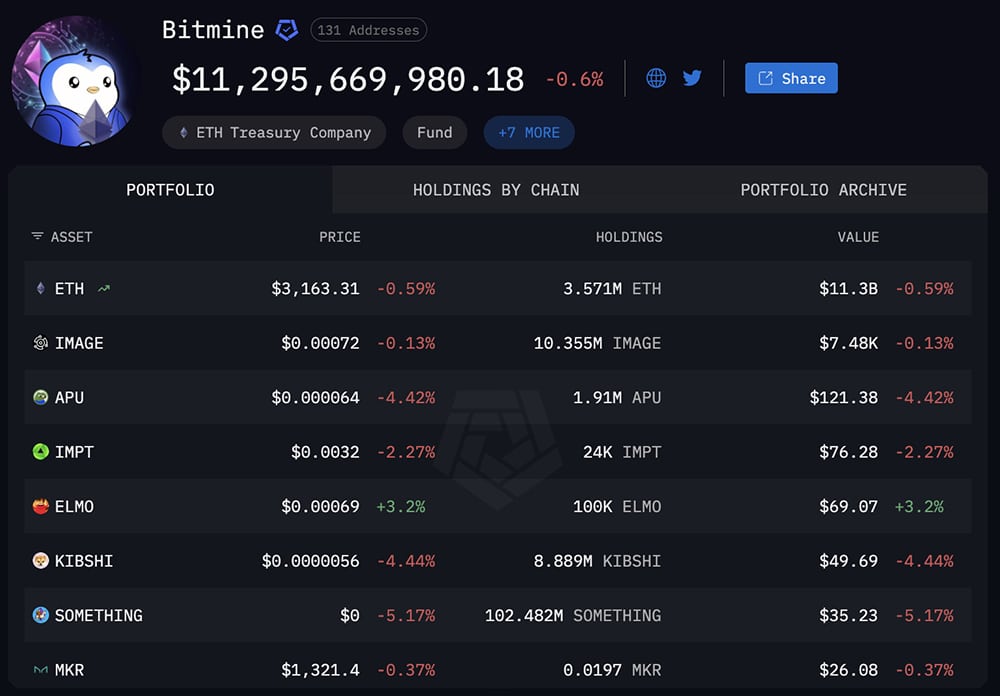

Lee’s confidence is based. On-chain labels connected to Bitmine ETH operations show that the firm added 41,946 ETH last week, lifting holdings beyond 3.57 million tokens. His positioning shows strong conviction that ETH USD is stabilizing, even as investors debate whether BTC USD can sustain its push toward the mid $90Ks.

(source – Bitmine, Arkham)

As we know, Tom Lee crypto calls tend to mark sentiment pivots. That and his forecast of crypto adoption jumping by as much as 200x, plus this deliberate buying pattern, the BTC USD recovery above $92K, the market is vibing.

💥 JUST IN: Tom Lee says Bitcoin and crypto have bottomed

“We’re going to shatter the Bitcoin 4-year cycle over the next 8 weeks.” pic.twitter.com/Kw8wcJogMn

— Bitcoin Archive (@BitcoinArchive) December 4, 2025

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Beyond Tom Lee, Bitmine, and Their ETH Crypto Buying Spree

Beyond Tom Lee and Bitmine, macro data also adds more weight to the bottom argument. While the headline on US inflation recently eased from earlier highs, the mixed components have boosted expectations that the Federal Reserve will lean toward easing soon.

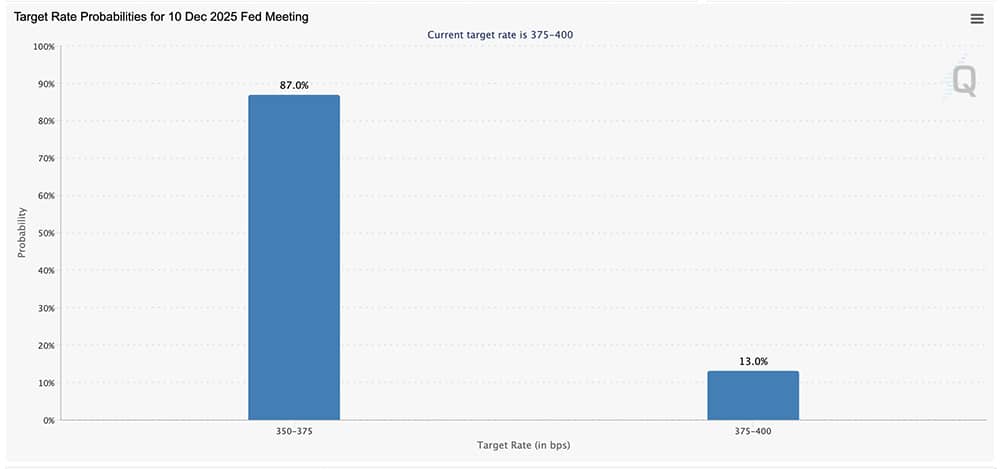

Rate-cut odds for the upcoming FOMC meeting now sit near 87%, and this shift usually funnels USD liquidity back into risk assets, especially BTC and ETH, which are quickest to react. Those following Tom Lee buying trends, any of his moves, are usually a confirmation of softening policy, which is a major crypto catalyst.

(source – CME FedWatch)

Quantitative tightening officially ended on December 1, freezing what had been a massive drain on liquidity. But an end to QT is not an immediate “go” signal. In 2019, QT ended months before crypto found a true bottom, in part because repo markets broke and forced emergency liquidity injections. This time around, the Fed stopped QT earlier to avoid repeating that mess. Still, real demand matters more than the absence of tightening.

(source – BTC USD, TradingView)

Another bullish altseason catalyst is coming from the declining BTC dominance. It slips under 60%, which is a hint at an incoming rotation, and following it, ETH/BTC just broke a three-month downtrend, which is historically a strong read-through for altcoin rallies.

To put it into perspective, Ethereum has held its weekly CME gap support for over two weeks, and volume is rising. Yet PMI recently ticked down to 48.2, still a contraction. Until that flips to expansion, liquidity doesn’t fully rotate into high-beta crypto, including Tom Lee crypto favorites and Bitmine ETH targets.

(source – ETH USD, TradingView)

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Liquidity’s Slow Turn and the Path for ETH USD and BTC USD

Bitmine ETH accumulation near the $3,000 zone shows long-term institutional confidence. Lee argues that Ethereum’s setup resembles Bitcoin’s early super-cycle, and if BTC can defend $92K USD and stretch toward $95K, the psychological path to $100K opens fast. ETH, which is holding above $3,100, could aim for $3,500 if it can hold the support line.

According to Tom Lee crypto logic, bottoms form quietly, but breakouts don’t. The next eight weeks may prove him right.

I think Ethereum’s going to become the future of finance, the payment rails of the future, and if it gets to .25 relative to Bitcoin, that’s $62,000. Ethereum at $3,000 is grossly undervalued. We’re going to shatter the Bitcoin 4-year cycle over the next 8 weeks.” – Tom Lee

DISCOVER: 10+ Next Crypto to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Gemini AI Predicts Volatile December for XRP, Dogecoin, and Shiba Inu Investors

ChatGPT competitor Gemini AI, developed by Google, has issued an incredible forecast for Ripple (XRP), Dogecoin (DOGE), and Shiba Inu (SHIB), along with a stark warning for investors. These leading altcoins could be set for a highly volatile December. Gemini projects sharp price swings for all three assets as 2025 comes to a close.

The broader crypto market has begun its slow recovery after a heavy correction phase triggered by heavy Bitcoin sell-offs. BTC USD dropped to $82,000 on November 30, its lowest level in eight months, and dragged the entire market down with it. Despite this turbulence, long-term sentiment in the industry remains largely positive, supported by ongoing innovation and increasing real-world use cases.

Bitcoin

1.13%

has since recovered and reclaimed $90,000, a key level for the leading digital asset. It is now trading between $90,500 and $94,000, preparing to move back above $100,000 before the year is out. The following is from Gemini AI, offering price analyses for XRP, DOGE, and SHIB.

Read the full story here.

ASTER DEX Holds Steady While Plasma Crypto Falters: What Some of The Best of 2025 Launches Reveal

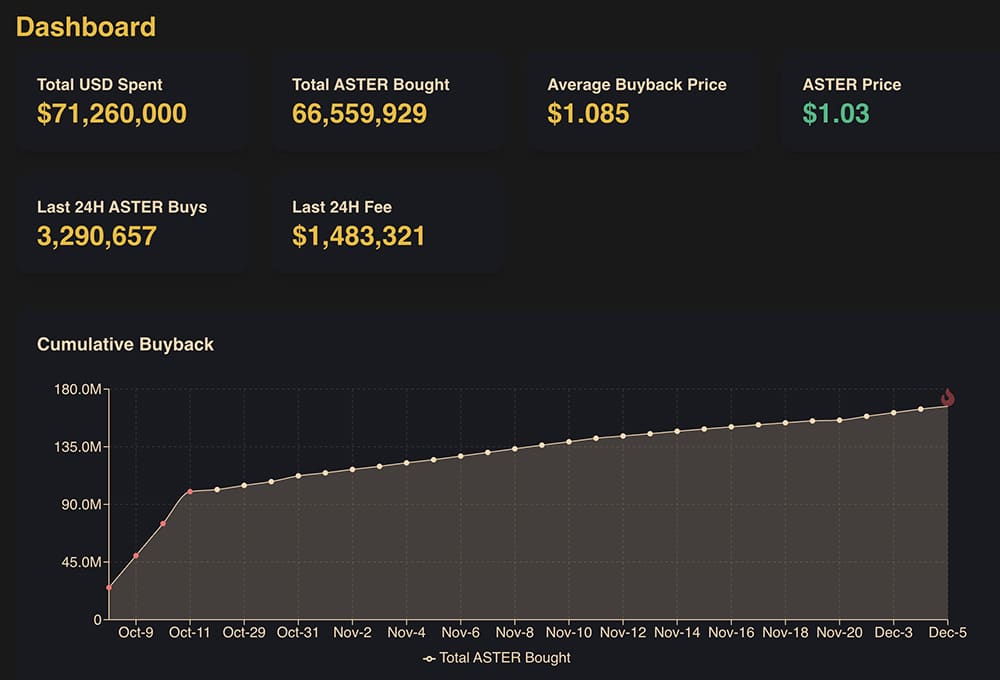

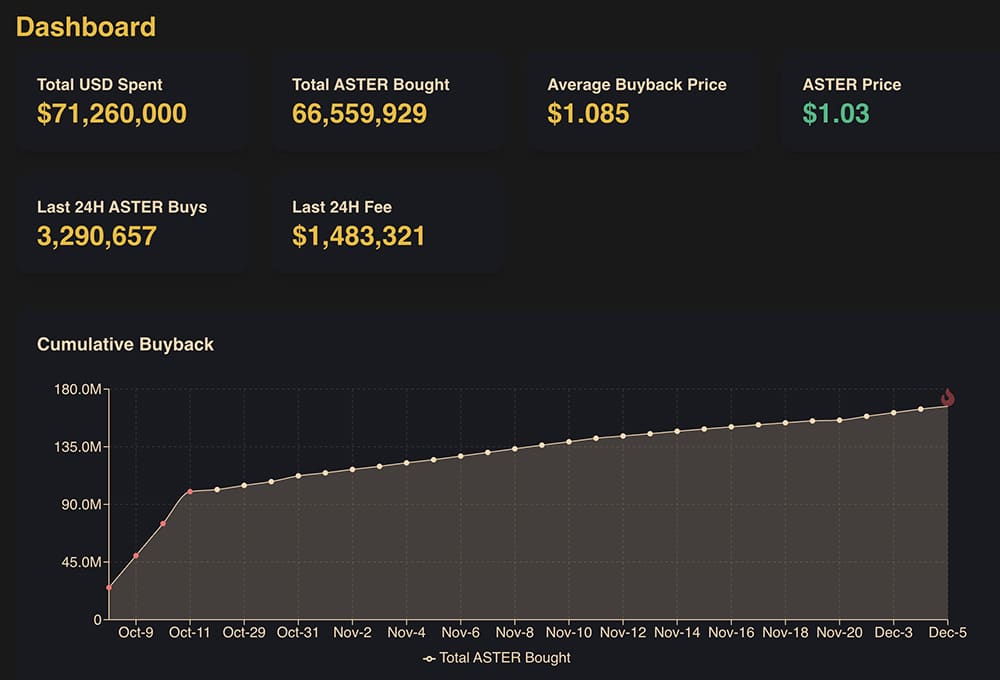

In the fast-paced crypto arena of 2025, ASTER DEX has loudly become one of the most successful launches. ASTER is now sitting firm around $1.03, even though the crypto sentiment is sour. On the flip side, Plasma crypto is wobbling, dropping near $0.18 after brutal post-launch pump dumps.

This current crypto divergence between ASTER, the DEX, and Plasma show luck, and what happens when execution, backing, and incentive design matter more than marketing hype.

ASTER owes its strength to solid backing, including support from CZ Binance, and a critical real buyback mechanism that cushions price pressure. Plasma, in contrast, launched under the promise of Tether backing and Paolo hype, but proved to be only loosely backed, a fatal flaw once the dust settled and holders rushed for the exits.

Airdrops played out very differently for the two. Plasma crypto gave early holders up to $10,000, generating good sentiment but triggering dumps in the aftermath. ASTER DEX user’s airdrops are ongoing, but backed by a heavy buyback program (over $71 million spent so far), softening outgoing pressure and building long-term credibility.

(source – Asterlify)

Performance metrics are also underlining the contrast, ASTER DEX is beating Bitcoin by ~15% year‑to‑date, whereas Plasma crypto lags Bitcoin by 25%. Compared to Ethereum layer‑2s rising 8% monthly, ASTER DEX still holds relative ground, but Plasma doesn’t make the cut, for now.

Read the full story here.

What’s happening with Web3 after the White House Crypto Summit? David Sacks, the Trump administration’s AI and Crypto Czar, is being accused of helping formulate policies that aid his Silicon Valley friends and many of his own tech investments.

Earlier in the year, Sacks and President Donald Trump unveiled a sweeping AI Action Plan drafted in part by Sacks himself, surrounded by executives from Nvidia, AMD, and a gallery of Silicon Valley allies who stood to benefit from the policy shift.

What the audience witnessed was not just a policy rollout, but direct collusion, according to NYT investigators. Here’s what to know and how this could hurt crypto:

“The tech bros are out of control.” – Steve Bannon

Read the full story here.

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content