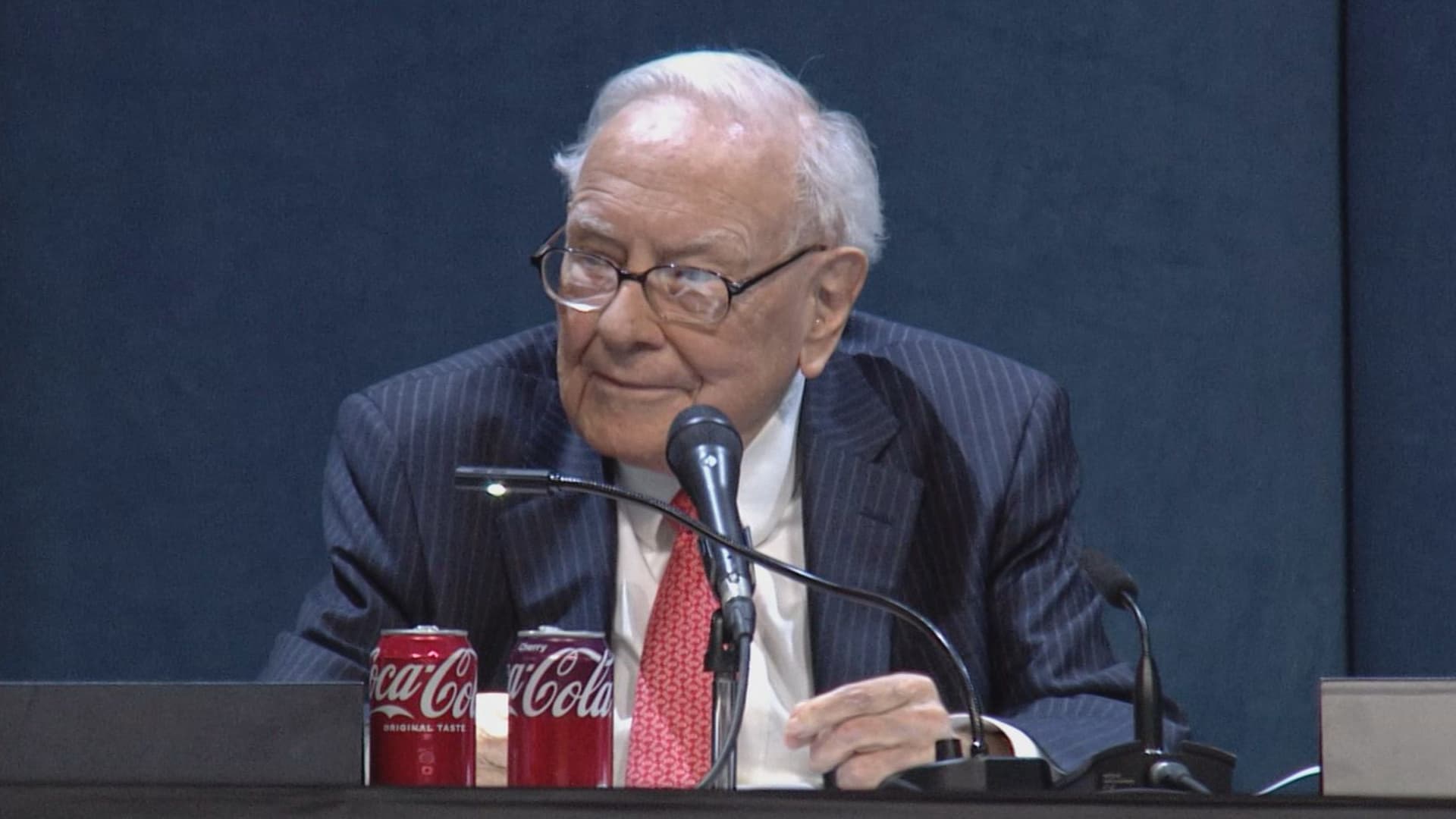

Warren Buffett on Saturday brushed off recent stock market volatility that has rattled investors over the past several weeks.

“What has happened in the last 30, 45 days … is really nothing,” the Berkshire Hathaway CEO said during the conglomerate’s annual meeting on Saturday.

Buffett pointed out that there have been three occasions over the last six decades where Berkshire Hathaway stock has declined 50%. He noted that there was no fundamental issued with the company during these periods.

Given that, he said the U.S. stock market’s recent action should not characterized as a “huge” move.

“This has not been a dramatic bear market or anything of the sort,” Buffett said.

These comments from the “Oracle of Omaha” come as investors wonder what’s next for markets after the wild trading seen amid concerns over President Donald Trump’s contentious tariff policy.

The S&P 500 on Friday notched its longest winning streak since 2004 as Wall Street claws back losses seen in the initial sell-off following Trump’s initial policy unveiling. It marks a stunning rebound for U.S. stocks after the benchmark index at one point entered a bear market on an intraday basis last month, a term used to describe a fall of more than 20% from its recent high, before regaining ground.

Buffett said other periods have been “dramatically different” than the current one facing investors. He reminded investors that the market has skyrocketed over the 94-year-old’s lifetime, while cautioning that they need to be ready for bouts of troublesome action.

“If it makes a difference to you whether your stocks are down 15% or not, you need to get a somewhat different investment philosophy,” Buffett said. “The world is not going to adapt to you. You’re going to have to adapt to the world.”

“People have emotions,” he added. “But you got to check them at the door when you invest.”

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content