In today’s crypto update, the broader crypto market has continued to shed value, with the crypto market cap extending further losses to $3.23 Tn from $3.25 Tn a couple of days ago.

(Source: CoinMarketCap)

0.69%

extended its losses further in the early hours of today’s trading session, falling to $93k, its lowest price since April this year, before the bulls stepped in and staved off any further losses, bringing the price to where it is currently trading at

.

The market is building upon the uncertainty as traders no longer expect the US Federal Reserve (Fed) to cut interest rates in December. Earlier this month, there was a 90% of a rate cut, now it’s closer to 40%.

Fed Rate Cut Odds Crash Below 50%!

Dec 9-10 meeting: CME FedWatch now only 45.8% chance of cut (down from ~90% weeks ago).

Hot Oct inflation (3.3%) + 261K jobs bomb = Powell & crew turn hawkish.

Markets bleed: stocks down, crypto shaky. No Santa rally? 📉❄️ #Fed #RateCut… pic.twitter.com/5YKOAIetjX— CryptoPulseIn (@CryptoPulseIn) November 17, 2025

The short term is incredibly difficult to predict. The Fed’s upcoming decision on the rate cut, government policies, and changes in how the BTC industry trends can move the market in ways that no one can predict.

In the meantime, BTC remains at the top of the crypto food chain with a $1.89 Tn market cap in spite of the recent downturn in its price action. In the last 24 hours alone, it saw $75.9 Bn in trading volume, indicating strong investor interest.

(Source: CoinMarketCap)

For BTC to reverse the trend, it must first retake the $96,000 level and then break decisively above the $100,000 key level, to then further hope to retest the $102,000-$105,000 zone.

EXPLORE: Top 20 Crypto to Buy in 2025

Crypto Update: ETH Maintains Above $3.1K

0.58%

is currently trading just below the $3,200 level at

after bouncing off the $3,100 support level. In the last 24 hours, ETH has managed to close the gap and is down by just 0.3%. On the weekly charts, however, it is still down by 11%.

(Source: CoinGecko)

If buyers step in, ETH can aim for the $3,500 key resistance level. Decisively breaking above this level might push the price towards $3,800. If ETH’s price action fails to capture the $3,500 level, there are chances for further slippage to $3,000 or lower.

$3,050 is acting as its short-term support level. If the price drops below that, the next key support zone is $3,000, which is also a psychological barrier.

$ETH retested the $3,000 support level and is now bouncing back.

Now, the next crucial level to reclaim is $3,500 and Ethereum bulls will be in some control.

In case of a rejection, ETH will go below $3,000 level. pic.twitter.com/jq4EHzSWpR

— CryptoGuyV (@viktor09693187) November 17, 2025

A clear break below $3,000 could lead to sharper corrections, with $2,880 as the next support. This level has held up in the past, and market hawks will be watching this level to see if buyers step in again.

If bearish momentum continues and ETH falls below $2,880, the price could slide further to $2,750 or even $2,640–$2,620.

🚨 BREAKING

INSIDER WITH 100% WIN RATE JUST OPENED NEW LONGS ON $BTC AND $ETH AFTER FED’S EMERGENCY MEETING.

SAME WALLET MADE MILLIONS LONGING THE PREVIOUS CRASH AND JUST WENT ALL IN AGAIN.

DOES HE KNOW THE BOTTOM IS IN?? https://t.co/fLPVnfSrow pic.twitter.com/j7ugHZbG2g

— 0xNobler (@CryptoNobler) November 15, 2025

Ethereum’s price is also closely tied to Bitcoin’s performance. Since BTC is facing its own resistance and slipping, ETH is feeling the pressure too. Until the broader market stabilizes, Ethereum may continue to move unpredictably.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Canadian Crypto Loopholes Add To Money Laundering Risks

A recent joint investigative report by CBC News, Radio-Canada, Toronto Star, and La Presse revealed that the Canadian crypto sector is highly susceptible to money laundering because of regulatory loopholes and lax enforcement.

(Source: X)

Unregistered crypto-to-cash services allow users to convert large sums of money into digital assets with little to no identity verification.

Platforms like 001k offered to deliver up to $1M in untraceable cash in exchange for Tether, bypassing Canadian financial laws entirely.

The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) lacks the wherewithal to track 2600 registered money transfer services. It definitely lacks the capacity to monitor unregistered ones.

Despite the country’s largest crypto seizure in September 2025, enforcement remains limited

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

Peter Schiff Calls Saylor A Fraudster: BTC Prediction For 2026

With the BTC USD price below $100,000, Bitcoin prediction models are bearish. The bad news is that it could get worse, especially if digital gold crashes below $90,000.

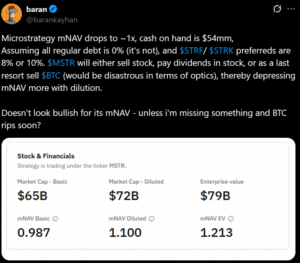

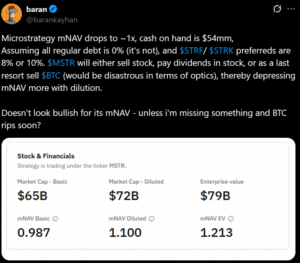

Every time the Bitcoin price ticks lower, MicroStrategy, the world’s largest holder of BTC, comes under renewed pressure. Last week, when BTC USDT fell below $100,000, MicroStrategy’s net asset value (NAV) fell below 1.

(Source: X)

That was enough of a scare because it meant everything the public company held was less than the value of its Bitcoin holdings. Would they be willing to sell if the situation becomes dire? Will investors demand action and protection?

Read More Here

Digital Asset ETPs Saw $2Bn In Outflows Last Week

The crypto landscape witnessed a $2 Bn outflow in digital asset ETPs last week, a figure not seen since February this year.

The outflows were mainly driven by interest rate uncertainty and large-scale selling by whales. The US accounted for nearly all of the offloading, with $1.97 Bn in outflows, with BTC and ETH leading the losses, with $1.38 billion and $689 million pulled out, respectively.

Digital asset ETPs saw US$2bn in outflows last week, driven by monetary policy uncertainty and crypto-native whale selling. Bitcoin and Ethereum led the losses with outflows of US$1.38bn and US$689m, while investors shifted toward multi-asset ETPs (+US$69m) and increased…

— Wu Blockchain (@WuBlockchain) November 17, 2025

This marks the third straight week of outflows, totaling $3,2 Bn.

Germany stood out as an outlier, attracting $13.2 M in fresh investment despite the global downturn.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content