The Cardano price is once again in the spotlight after the latest FOMC decision, with ADA attempting to stabilize following another volatile macro week. With the Federal Reserve delivering its third consecutive 25-basis-point rate cut, traders initially rushed into risk assets, but the reaction faded quickly.

The big question now is whether December will bring meaningful upside for Cardano crypto holders or more chop as the market processes the implications of the new policy direction.

FOMC Cuts for the Third Time – What Does That Mean?

Yesterday’s FOMC meeting delivered exactly what markets anticipated. The Federal Reserve cut rates by 25 basis points for the third consecutive meeting, solidifying its shift from quantitative tightening toward an accommodative stance.

QT has officially wound down and announced that it will make new $40Bn purchases of Treasury bonds over the next 30 days.

TODAY’S FED FOMC WAS VERY BULLISH.

🇺🇸 The U.S. Fed may have just started the next liquidity wave with 3 rate cuts and a $40 billion in Treasury buying.

Today’s FOMC meeting delivered one of the clearest shifts toward easing we’ve seen in the past few years.

The Fed cut rates… pic.twitter.com/hYnaOlaM0e

— Bull Theory (@BullTheoryio) December 10, 2025

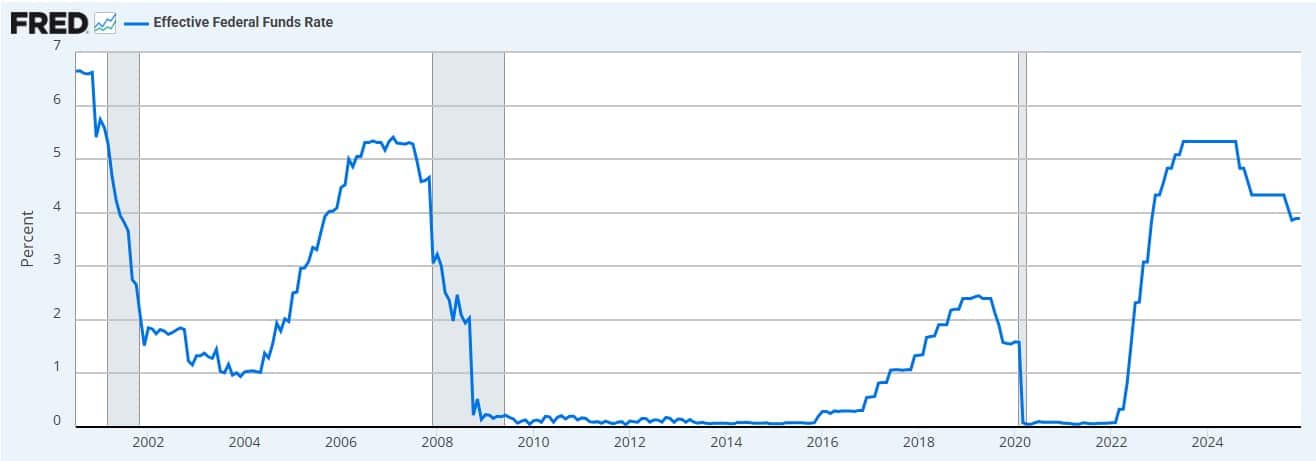

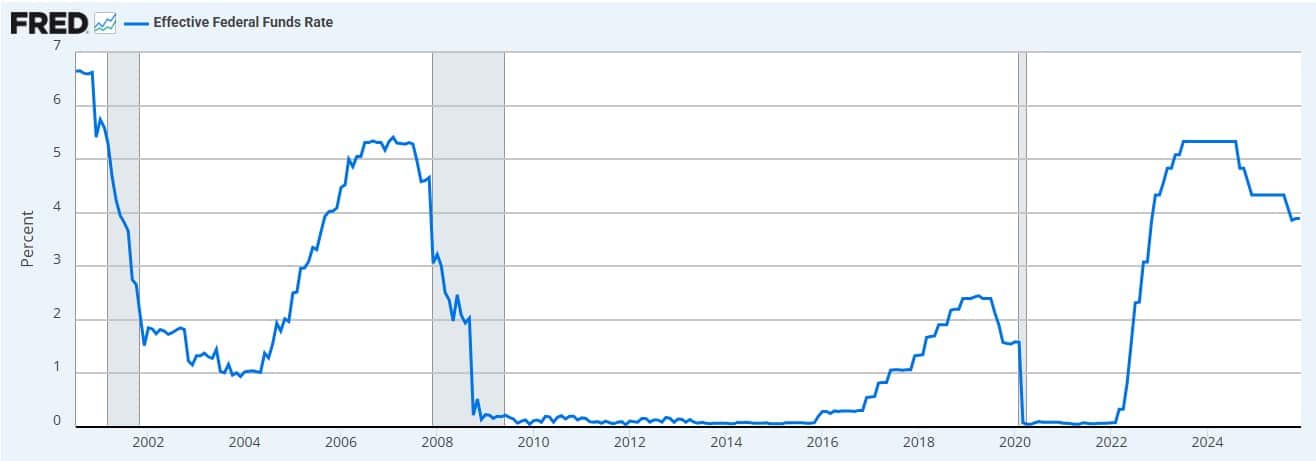

Historically, aggressive rate-cut sequences almost always occurred during periods of deep financial stress. The year 200 saw cuts shortly before the dot-com collapse. The 2008 sequence attempted to soften the impact of the global economic crisis. In early 2020, emergency cuts arrived just before markets broke under the pressure of the pandemic.

(Source – stlouisfed)

Rate cuts themselves weren’t the cause of those crises; they were the warning signs that the system was under strain. While cutting rates is usually seen as bullish for risk assets, the reaction is not always straightforward, as past episodes show.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

Cardano Responds to the Cuts, But Gains Fade Fast

ADA reacted strongly to the early wave of optimism, only to retrace the entire move within hours. This type of round-trip behavior is typical when markets face major macro announcements, especially during cycles where liquidity uncertainty is high. The rate cut itself was no surprise, but traders had been preparing for it for days, turning the event into a classic sell-the-news setup.

(Source – CoinGecko)

Despite the volatile reaction, Cardano’s fundamentals heading into Q1 2026 look structurally strong. The Midnight privacy sidechain is now live with liquidity operations rolling into early next year. The ouroboros Leios scaling work continues to progress, laying the foundation for meaningful throughput improvements.

Privacy isn’t an add-on. It’s the missing piece.

Fresh off his keynote at Midnight Summit, @IOHK_Charles joined the #Unshielded podcast to break down how Midnight is bringing rational privacy to blockchain—from Ethereum and Solana to Cardano and beyond.

Fair-launch… pic.twitter.com/Xf6b2r6xdC

— Midnight (@MidnightNtwrk) November 25, 2025

Hydra’s settlement layer achieved record performance and is moving closer to wider deployment through governance upgrades. Treasury initiatives and cross-chain integrations show an ecosystem increasingly focused on maturity and institutional readiness. A confirmed Tier-1 stablecoin for both Cardano and Midnight is also expected early next year, a key piece for DeFi expansion. This series of developments positions ADA well, even if macro turbulence continues and headline volatility remains elevated.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

What Does Technical Analysis Say?

On the 4-hour timeframe, ADA pumped roughly 13% immediately after the FOMC decision, retesting the lower band of the 200-day EMA and SMA. Momentum stalled at that level, which was rejected, pushing the price back toward the day’s opening. This kind of choppy movement is common around FOMC decisions and does not signal that ADA’s recovery attempt is over.

(Source – TradingView)

RSI continues to show bullish divergence, a sign that sellers may be losing strength. The MACD remains inconsistent, occasionally flipping positive but struggling to maintain momentum, due to short-term volatility.

The daily timeframe, however, paints a noticeably stronger picture. RSI is recovering above its average, indicating renewed momentum, while MACD is turning positive for the first time since the October 10 flash crash. These are early signs that ADA could build a more sustained uptrend if macro conditions cooperate.

(Source – TradingView)

The key resistance to watch is the $0.64 region. A clean breakout from that zone could open the path toward the parabolic move hardcore hodlers are waiting for. This could happen in December, particularly if risk sentiment continues to improve in the early stages of quantitative easing. No one can predict the exact outcome, but what is evident is that ADA remains a mainstay in the Layer-1 landscape.

Even if markets face deeper turbulence ahead, Cardano price has the resilience, technology, and community strength to outlast the storm.

DISCOVER: 10+ Next Crypto to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Key Takeaways

Cardano price rebound amid 3rd consecutive rate cuts in December.

What is the future of ADA?

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content