Chainlink recently launched its LINK reserves feature that allows it to channel its on-chain and enterprise fees into it. Data compiled on its website shows that it now has 109,663 LINK tokens in its reserves. Chainlink is quickly becoming the best altcoin to buy in 2025.

With LINK currently trading for $24.6, the reserves are valued at over $2.8 million, and this number is expected to continue rising. Thus far, the strategy has been profitable, with the LINK cost basis being $19.65.

Chainlink Reserve Launched On August 7: Has Everything Changed For LINK Price?

Launched on August 7, The Chainlink Reserve is being built up by using Chainlink’s Payment Abstraction protocol to convert off-chain and on-chain revenue into LINK.

Introduced earlier this year, Payment Abstraction is an on-chain infrastructure that reduces payment friction by enabling users to pay for Chainlink services in their preferred form of payment, such as gas tokens and stablecoins.

Payments are then programmatically converted to LINK using a combination of Chainlink services and decentralized exchange infrastructure. The Chainlink team has stated that it does not expect any withdrawals from the Reserve for multiple years, and so it is expected to grow over time.

Crypto trader @CatfishFishy made a solid point regarding the new Chainlink Reserve and how it helps to eliminate the last remaining fud around LINK, especially in comparison to Ripple Labs and the XRP token.

The trader said, “(Chainlink Reserve) Killed two biggest FUD uncertainties: Chainlink is a money-making machine already. Clear confirmation about no predatory, competing conflicts like Ripple Labs equity vs XRP token holders. Chainlink generates revenue from useful services -> LINK token buybacks & yield to stakers.

Ripple makes 99% of its money from dumping XRP – Ripple buys companies for itself and its own Ripple stock. Future fees will be in the billions. Chainlink platform is needed by DeFi + TradFi more than any other protocol to deploy on-chain finance use cases at scale because no other protocol offers what Chainlink does.”

DISCOVER: The 12+ Hottest Crypto Presales to Buy Right Now

Other Chainlink News And Announcements Boosting Positive LINK Sentiment

BREAKING

Chainlink has partnered with NYSE parent ICE to bring forex and precious metals data onchain

TOKENIZE THE WORLD WITH $LINK pic.twitter.com/HuVrqP2Oe7

— Quinten | 048.eth (@QuintenFrancois) August 11, 2025

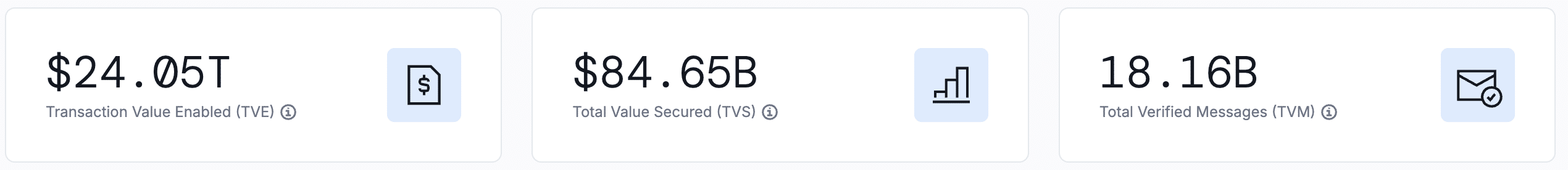

Chainlink’s total value secured (TVS) on its platform continues to grow, reaching over $84 billion, with most of the funds allocated to Ethereum’s network.

In addition, Chainlink has secured partnerships with some of the largest companies worldwide. Most recently, it announced a significant collaboration with Intercontinental Exchange (ICE), the parent company of the New York Stock Exchange.

(SOURCE)

This partnership will enable ICE to utilize Chainlink’s technology to enhance its foreign exchange and metals trading. This is just one example of how Chainlink’s cross-chain interoperability protocol (CCIP) is being applied in the real-world asset tokenization industry.

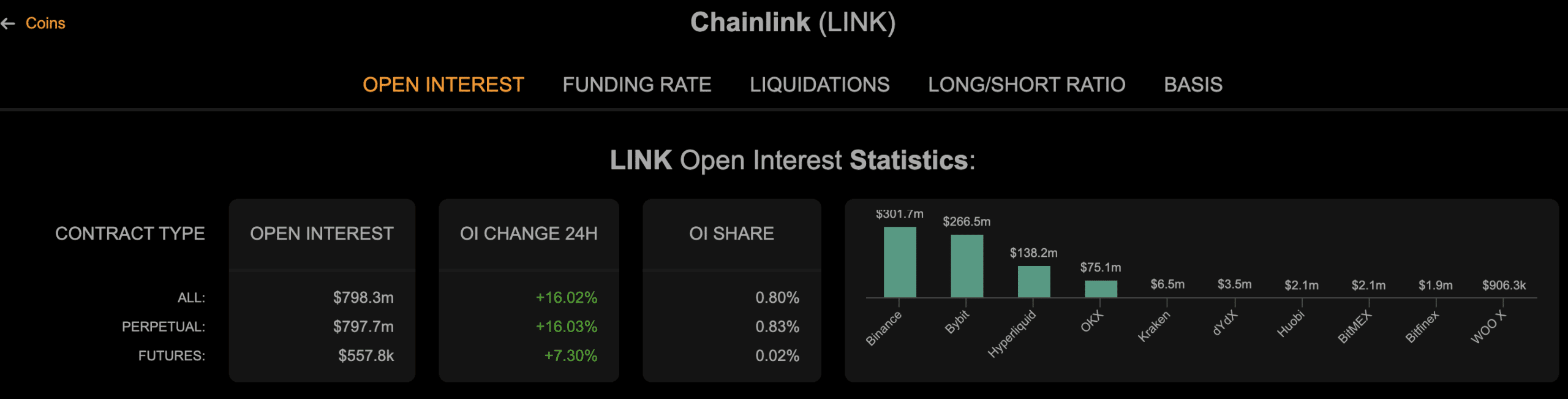

Meanwhile, demand for the LINK token remains high. Its futures open interest sits at $798.3m in the past 24 hours, after surging to a record $1.5 billion last week, a considerable increase from the year-to-date low of $421 million.

Coinalyze data shows that the Chainlink OI (open interest) is up over 16% since yesterday, highlighting the strength and demand for LINK and strengthening its claim as the best altcoin to buy in 2025.

(COINALYZE)

Whales Are Stacking LINK And Price Action Is Bullish: Is Chainlink The Best Altcoin To Buy This Year?

Whale accumulation has continued this month, with large investors now holding over 5.6 million LINK tokens. This represents an increase of more than 65% in just one month.

Whale buying is often seen as a bullish indicator for a token, as it reflects strong demand from investors who have a significant stake in the market and the means to control the charts.

The Relative Strength Index and the MACD indicators have continued to rise as bulls target the key resistance level at $27.18, its highest point since January this year. A move above that level will indicate a move toward the psychological resistance at $30.

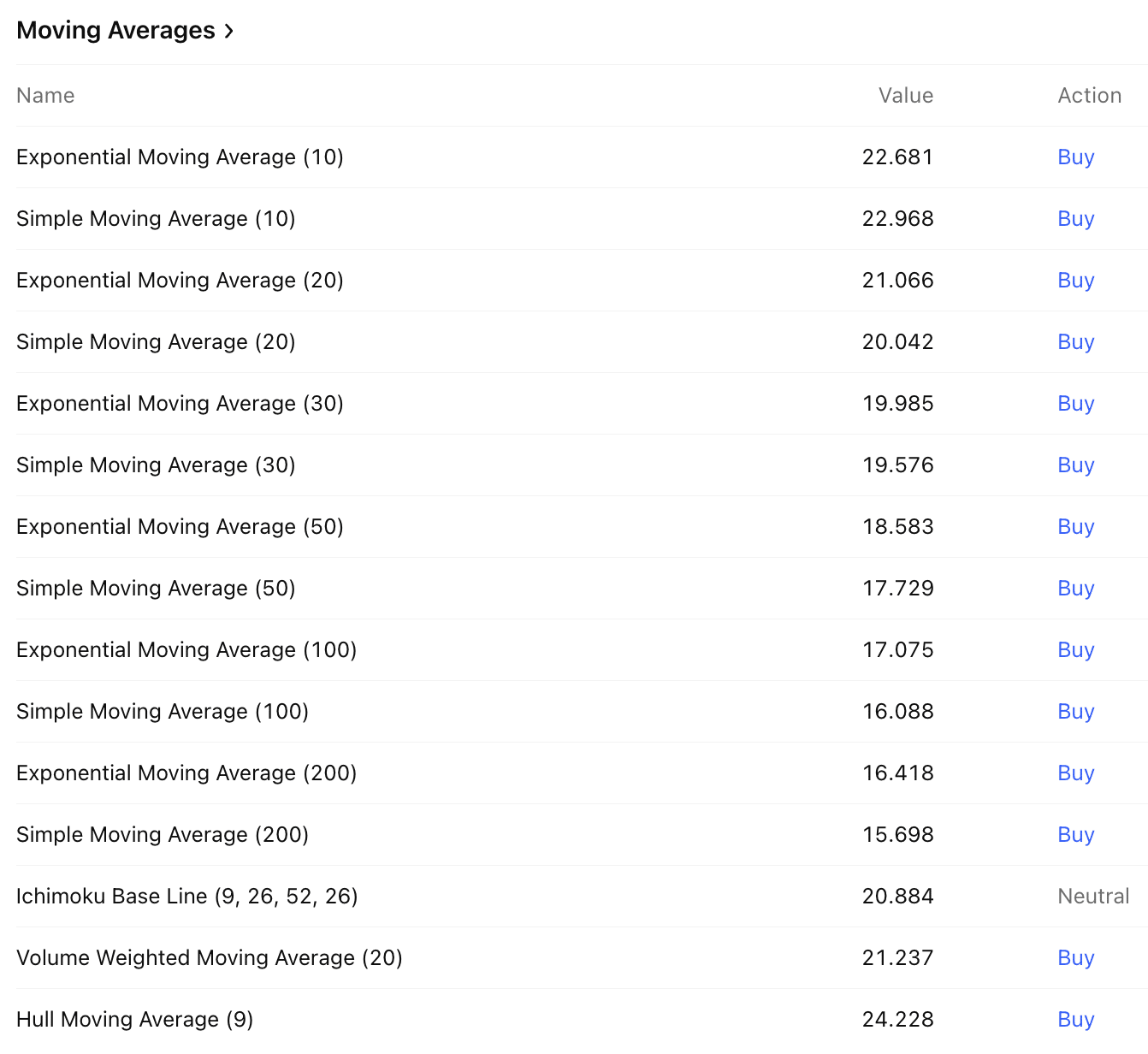

Incredibly, all of the TradingView moving averages show a buy signal, both EMA’s and SMA’s across 10, 20, 50, 100, and 200 day timeframes. With the majority of indicators flashing heavy buy signals for LINK, it is quickly cementing itself as the best altcoin to buy as we head deeper into 2025.

While the majority of digital assets are red on a 7-day timeframe, LINK is up nearly 12%, highlighting its strength during this current dip. Chainlink has moved up to number 12 in the list of biggest cryptocurrencies by market cap, overtaking wrapped Bitcoin (wBTC) and Lido’s wrapped Ethereum (stETH).

LINK’s current market cap is around $16.5 billion, and many analysts call for It to become a top-five digital asset in the near future. Institutional usage coupled with the Chainlink Reserve program drives the LINK price higher.

(TRADINGVIEW)

EXPLORE: 10 Best AI Crypto Coins to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Reserves Could Trigger a Chainlink Skyrocket: Is LINK The Best Altcoin to Buy in 2025? appeared first on 99Bitcoins.

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content