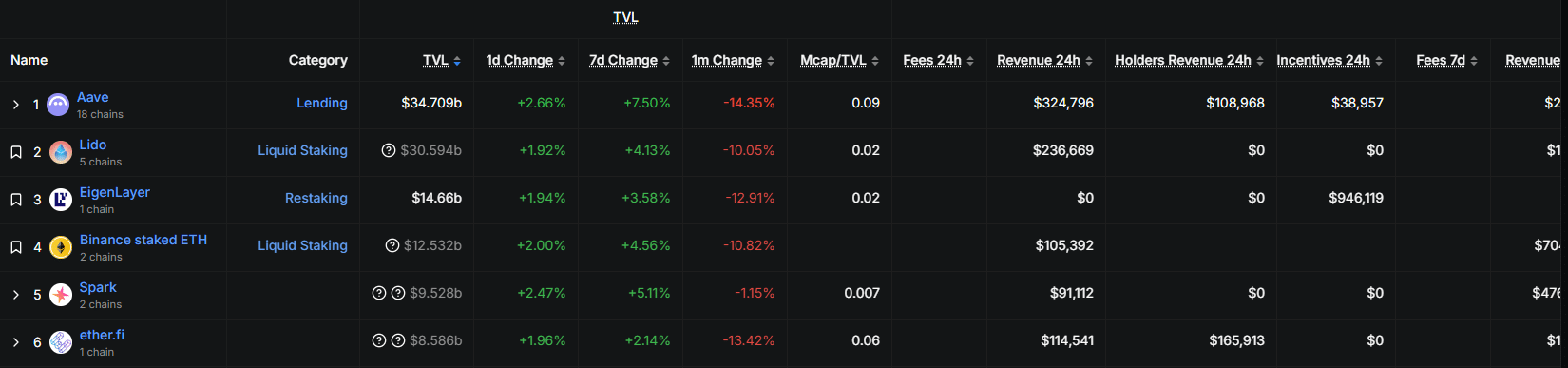

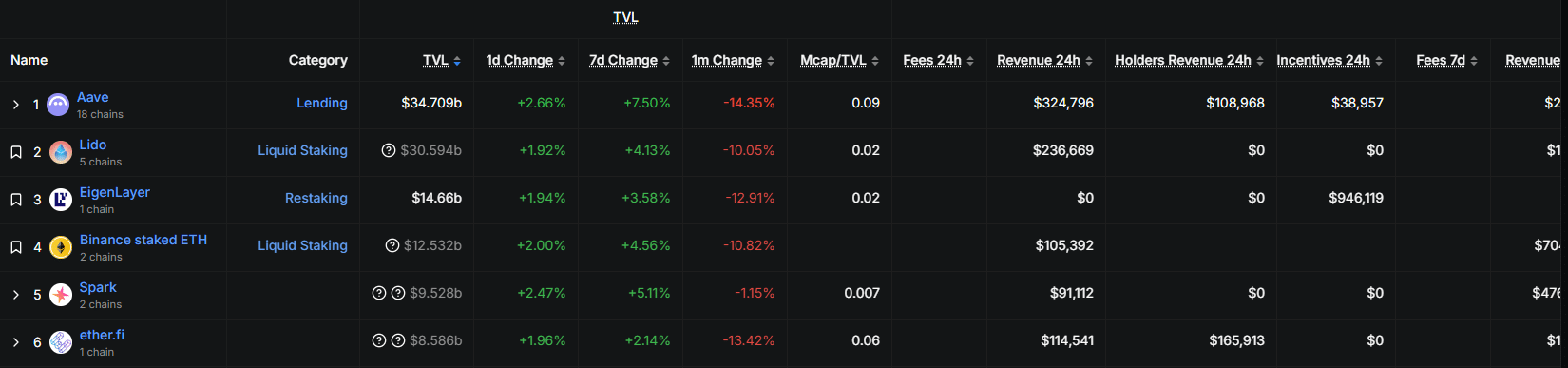

For Aave to emerge as the largest DeFi protocol by total value locked (TVL) is sufficient evidence that crypto holders are eager to lend or borrow assets at any time of day.

As of November 13, Aave manages over $34Bn worth of assets spread across 18 chains but primarily on Ethereum and its layer-2s, including Base. While the DeFi collapse in late October and early November threatened to wipe out liquidity, there are signs that confidence is returning.

While inflow in the last month is in negative territory across most protocols, not just Aave, the top five DeFi dapps have been drawing capital in the last week. Inflows to Aave is at 7.5% in the previous week while Ether.fi saw a decent 2% increase in TVL during that time.

(Source: DefiLlama)

DISCOVER: 10+ Next Crypto to 100X In 2025

Aave To Delist Uniswap, PancakeSwap, Balancer, and Top DeFi Tokens As Lending Collateral?

Bullish as this inflow is, Aave is aware of what happened after the Balancer hack, and the crash of October 10 is still being felt not just by the top decentralized money market but by all lending platforms.

In a post on X, Ignas, a DeFi researcher, revealed that the Aave community is advancing a proposal that is likely to be controversial, to delist, among others, Uniswap and PancakeSwap tokens as lending collateral.

Another consequence of 10/10 crash:

Aave is removing volatile alts as collateral: $CRV, $UNI, $ZK, $BAL, $LDO, 1INCH, $METIS, $CAKE

During the crash, oracle prices jumped 15% to 50% in single updates.

Some feeds lagged by minutes posing risk of bad debt:

If the oracle shows a… pic.twitter.com/wk8gk3Tuqw

— Ignas | DeFi (@DefiIgnas) November 13, 2025

The goal is to gradually reduce the collateral ratio of these tokens to zero before delisting them from Aave lending functions.

In his research, and perhaps as a basis for justifying this delisting, Ignas observed that oracle prices of these tokens jumped by anywhere between 15% and 50% in a single Chainlink update during the October 10 crash.

What’s crucial to note is that some Chainlink feeds lag by minutes, posing a risk to Aave.

The lag allowed arbitrage bots to drain roughly $200,000 using CRV as collateral on Aave. Another bot also made over 17 wETH, taking advantage of the ENS price difference due to Chainlink oracle lags.

Besides the Chainlink oracle lag experienced during the crash, the researcher also revealed that these tokens, after all, earn very little for Aave.

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

Blame Chainlink or Alts?

Still, AAVE holders must vote on this proposal before any actions are taken.

However, Oracle lags seem to be the main reason why this proposal is being floated.

Aave relies on Chainlink, a decentralized oracle provider, for price feeds.

While AAVE crypto also fell during the crash, risks posed by oracle lags create room for arbitrage opportunities that can lead to bad debt, costing the protocol millions, if not hundreds of millions of dollars.

The primary reason for this lag and depeg of some stablecoins was due to the thin liquidity, which worsened volatility and caused some assets used as collateral on Aave to detach.

Aave took a hit, auto-liquidating roughly $180M of loans. But, it could have been worse because USDe depegged briefly.

(Source: ChainLinkGod, X)

On Aave, USDe’s oracle price is hardcoded to USDT. And since USDT didn’t depeg, USDe-backed loans weren’t auto-liquidated.

DISCOVER: 9+ Best Memecoin to Buy in 2025

Will Aave Delist Uniswap, PancakeSwap, Balancer Tokens?

-

Aave is the largest DeFi protocol by TVL. -

Decentralized money market manages over $34Bn of assets. -

Altcoins crashed on October 10, causing massive oracle lags. -

Will Aave delist Uniswap, PancakeSwap, Balancer and others?

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content