Arthur Hayes says Zcash is now his second-largest liquid holding after Bitcoin, and the market took notice.

The BitMEX co-founder shared the update on X late Friday. He said his family office, Maelstrom, now holds more ZEC than anything else except Bitcoin.

Due to the rapid ascent in price, $ZEC is now the 2nd largest *LIQUID* holding in @MaelstromFund portfolio behind $BTC.

— Arthur Hayes (@CryptoHayes) November 7, 2025

He posted the comment after a sharp jump in Zcash, which has sparked fresh talk about whether major traders are warming up to privacy coins again.

Why Has ZEC Become the Second-Largest Asset in Hayes’ Portfolio?

Hayes didn’t say he sold Bitcoin to build the position. He described it more as a shift driven by recent price action rather than a big portfolio reshuffle.

By early Monday, ZEC traded in the mid-$600s while Bitcoin sat near $105,000. In a post on X, Hayes said ZEC climbed to the second-largest spot in his portfolio “due to the rapid ascent in price,” hinting that the token’s strong move shifted his overall allocation.

Maelstrom, his family office, says it invests in liquid tokens and private deals.

Hayes has spoken often about ZEC in recent weeks. He has shared long-term goals for the token on social platforms and during interviews.

He also suggested Zcash could claim part of Bitcoin’s value if privacy becomes a stronger theme again.

Those remarks coincided with outsized ZEC gains since October and fresh media coverage over the weekend highlighting its climb into large-cap territory.

Zcash is a Bitcoin-like asset with a 21M coin cap that adds shielded transactions through zero-knowledge proofs. This lets users keep amounts and addresses private when they choose.

That feature set has returned to the spotlight as interest in on-chain privacy picks up again.

DISCOVER: 20+ Next Crypto to Explode in 2025

Zcash Price Prediction: Is Growing Open Interest Showing Stronger Bullish Momentum?

Zcash has been gaining traction over the past month. Futures activity picked up sharply, and Futures Taker CVD stayed positive for 30 days straight, a sign that buyers have been in control.

(Source: Coinglass)

Most traders in the futures market leaned toward the buy side, opening positions on both long and short trades to capitalize on the moves.

Lookonchain pointed to one large buyer after ZEC fell to $509.

A mysterious whale created a new wallet (0x6EF9) 14 hours ago and deposited 6.27M $USDC into Hyperliquid, placing a limit long order at $509.5 on $ZEC.

9 hours ago, the order fully filled — now holding 20,833 $ZEC($12M) with an unrealized profit of $1.44M.… pic.twitter.com/eZt2TrirgV

— Lookonchain (@lookonchain) November 9, 2025

According to the tracker, the whale sent $6.27 million to Hyperliquid and placed a limit-long order for 20,800 ZEC, worth approximately $ 12.12 million.

As the market moved higher, the trader’s position briefly showed approximately $1.51 million in unrealized gains. They later closed the trade and walked away with roughly $1.25M in profit.

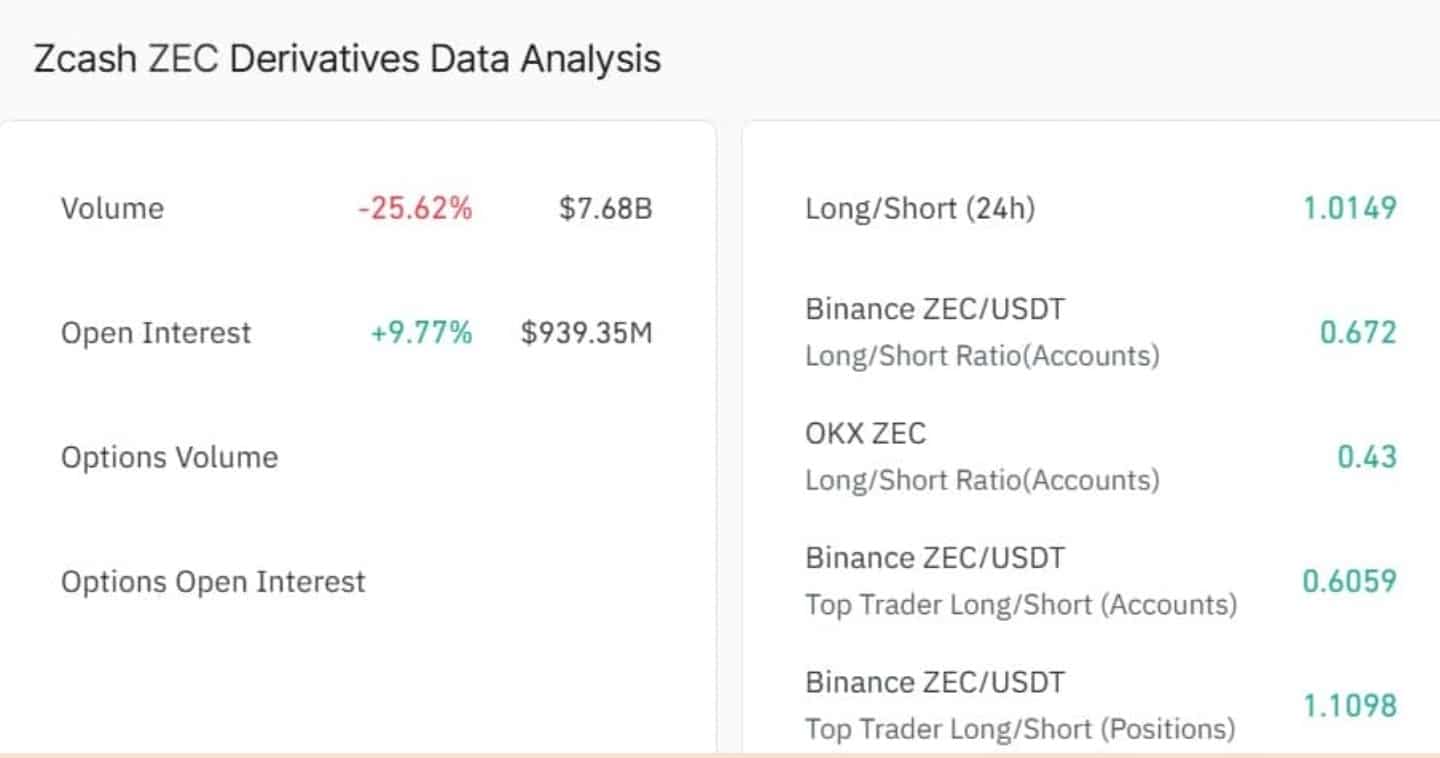

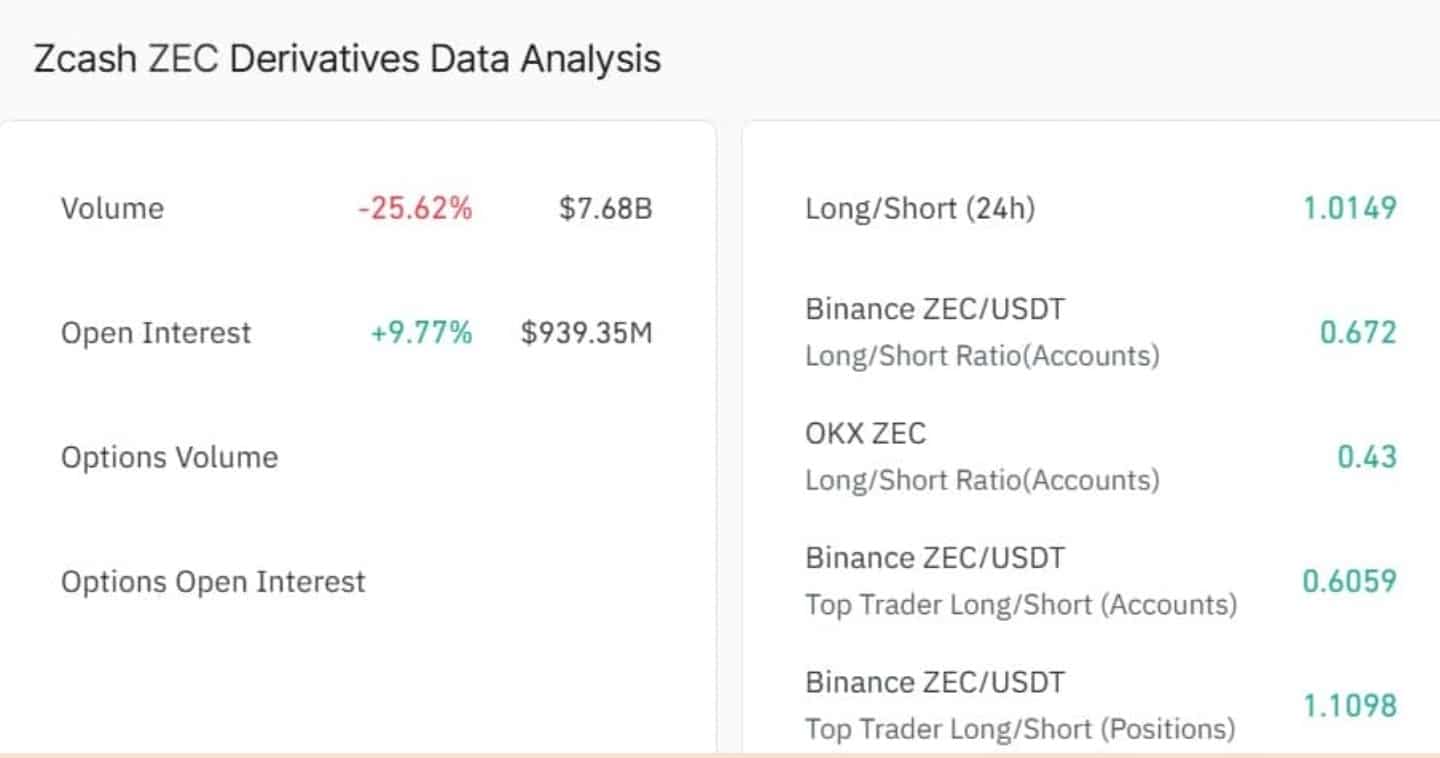

Futures activity also picked up. CoinGlass data shows Zcash open interest rose about 9.8% to $939.31M, suggesting more money is flowing into ZEC futures.

(Source: Coinglass)

Long-short positioning also leaned slightly bullish. CoinGlass listed a 24-hour Long/Short Ratio near 1.01.

On Binance, top traders posted a higher reading of 1.11, showing more traders were still favoring long bets.

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

Why you can trust 99Bitcoins

Established in 2013, 99Bitcoin’s team members have been crypto experts since Bitcoin’s Early days.

90hr+

Weekly Research

100k+

Monthly readers

50+

Expert contributors

2000+

Crypto Projects Reviewed

Follow 99Bitcoins on your Google News Feed

Get the latest updates, trends, and insights delivered straight to your fingertips. Subscribe now!

Subscribe now

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content

https://www.profitablecpmrate.com/nsirjwzb79?key=c706907e420c1171a8852e02ab2e6ea4

Skip to content